What is a business bank account?

Business bank accounts work in the same way as personal ones – enabling you to transfer money, pay for services and track spending. But they often also include a few additional features, such as a personal advisor and tailored introductory offers.

- Personal support: As a business customer, you’ll get a dedicated support team to guide you through the bank’s services. They’ll be able to provide advice as your needs change, and sometimes personalised offers.

- Introductory periods: Many banks won’t charge you for the first year or so after opening your account.

Do I need a dedicated bank account just for my business?

If you are setting your business up as a limited company, you are required by law to have a dedicated business bank account.

Although it might seem unnecessary in the early stages of running a business, setting up a dedicated bank account for your business will remove many of the everyday difficulties that can make maintaining accurate accounts such a complicated and time-consuming task. In addition to a variety of other tools and services, by opening a business bank account, you will find it easy to keep track of:

<ul>

<li>Overall available balances</li>

<li>Money owed to the business</li>

<li>Up-to-date employee payroll information</li>

<li>Money your business owes to any creditors</li>

</ul>

How do I compare the best business bank accounts in the UK?

Finding the right bank account for your business is crucial to keeping on top of your finances. A lot of banks have excellent introductory offers that can provide real value for your business. But, you should consider your business needs in the long term. This will help you to decide which account will benefit your business and help you grow. You can read more about the best business bank accounts in the UK and key things you need to think about before opening a bank account for your business, including:

- How easy it is to switch

- Online banking facilities

- Security

- Fees and costs involved

- Easy integration with your accounting software

- Multi-currency facilities

How do I open a business bank account in the UK?

If you fit the criteria outlined by your provider, setting up a business account in the UK is fairly straightforward. In short, you should have the following details to hand:

- Business address

- Contact information, including a current telephone number

- Companies House registration number (if you are a limited company or partnership)

- Estimated annual turnover

It is also worth noting that you may also need to provide evidence of your financial circumstances in verifying that you have a clean banking and credit history. We’ve gone into more detail about things you need to open a company bank account in this article.

When do I need more than one business account?

As a business owner, you can sometimes find it challenging to keep tabs on just how much money the company is holding and what your immediate business commitments are. One solution is to consider the possibility of having more than one business account with the same, or different banks. Typically, you will have a current account and a savings or reserve account. This is useful sometimes, but it doesn’t give you the same amount of control that two independent accounts can. It is a question of what’s best for your business and how you prefer to organise your business finances.

Do I need a multi-currency bank account for business?

For businesses dealing with various currencies, a multi-currency bank account can be useful. If your business operates across several countries and uses different currencies, a multi-currency bank account will be invaluable in mitigating fees for foreign currency exchange. Every bank will offer something slightly different, such as varied interest rates, different charging structures, and linked benefits such as savings accounts or overdrafts.

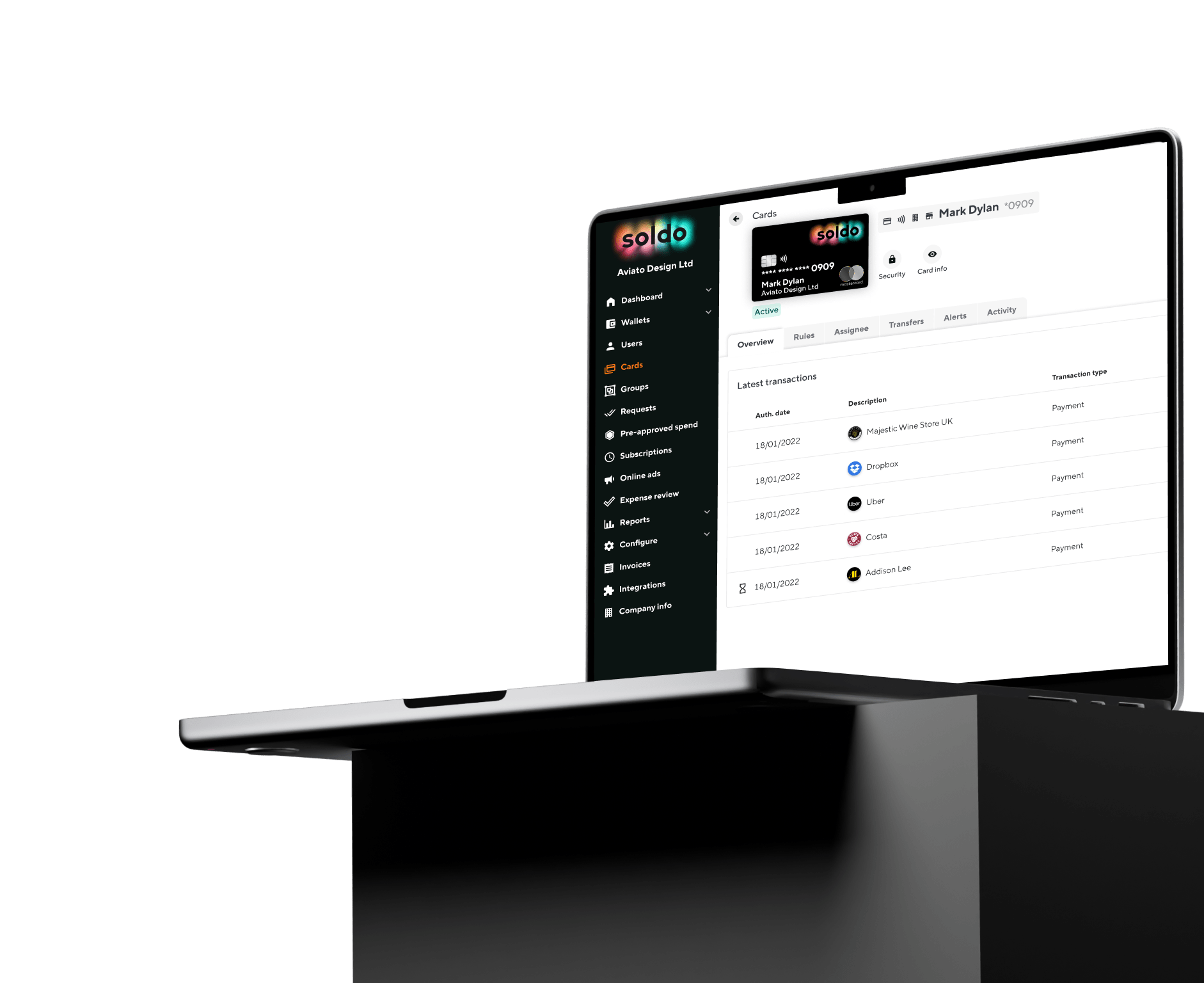

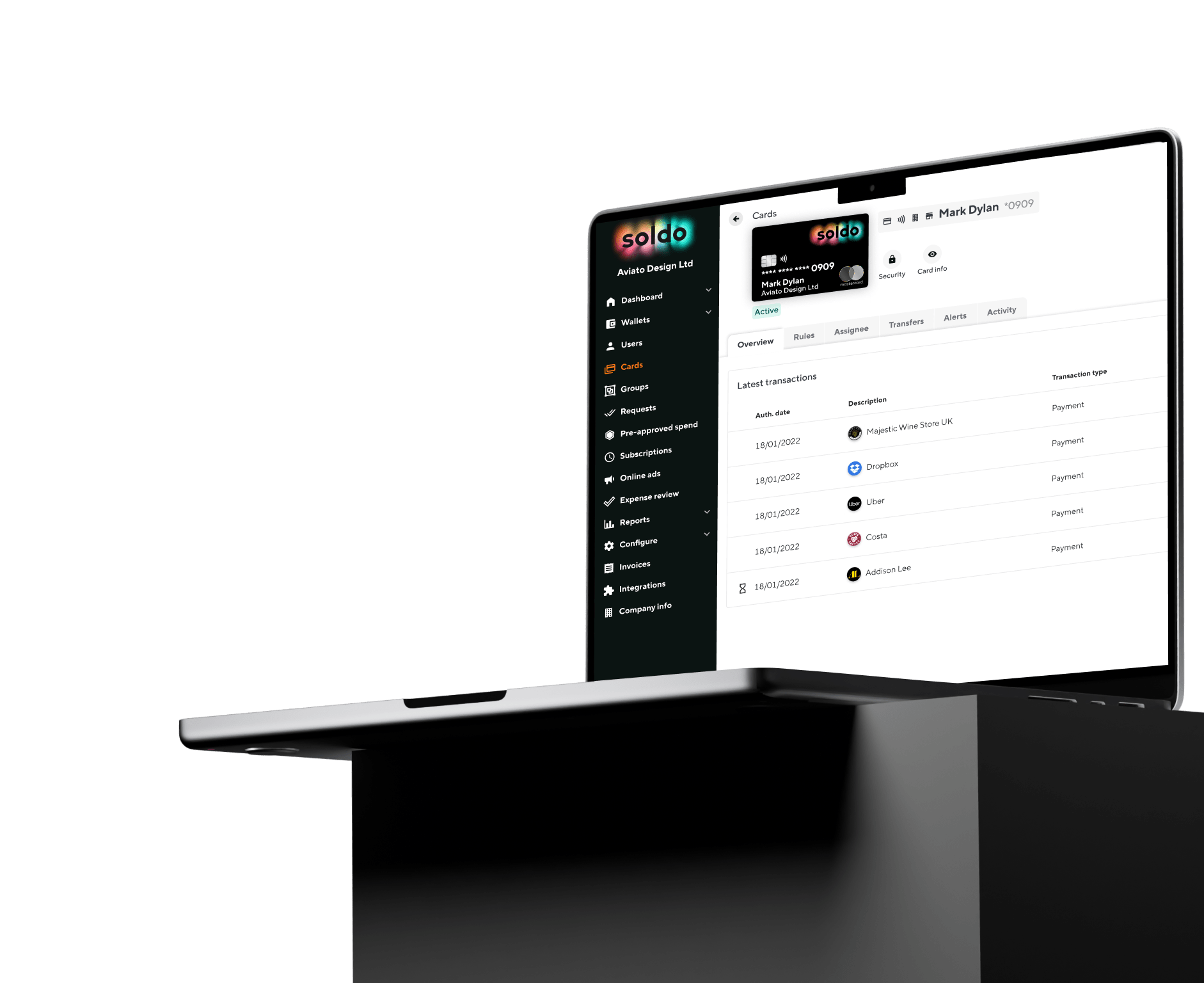

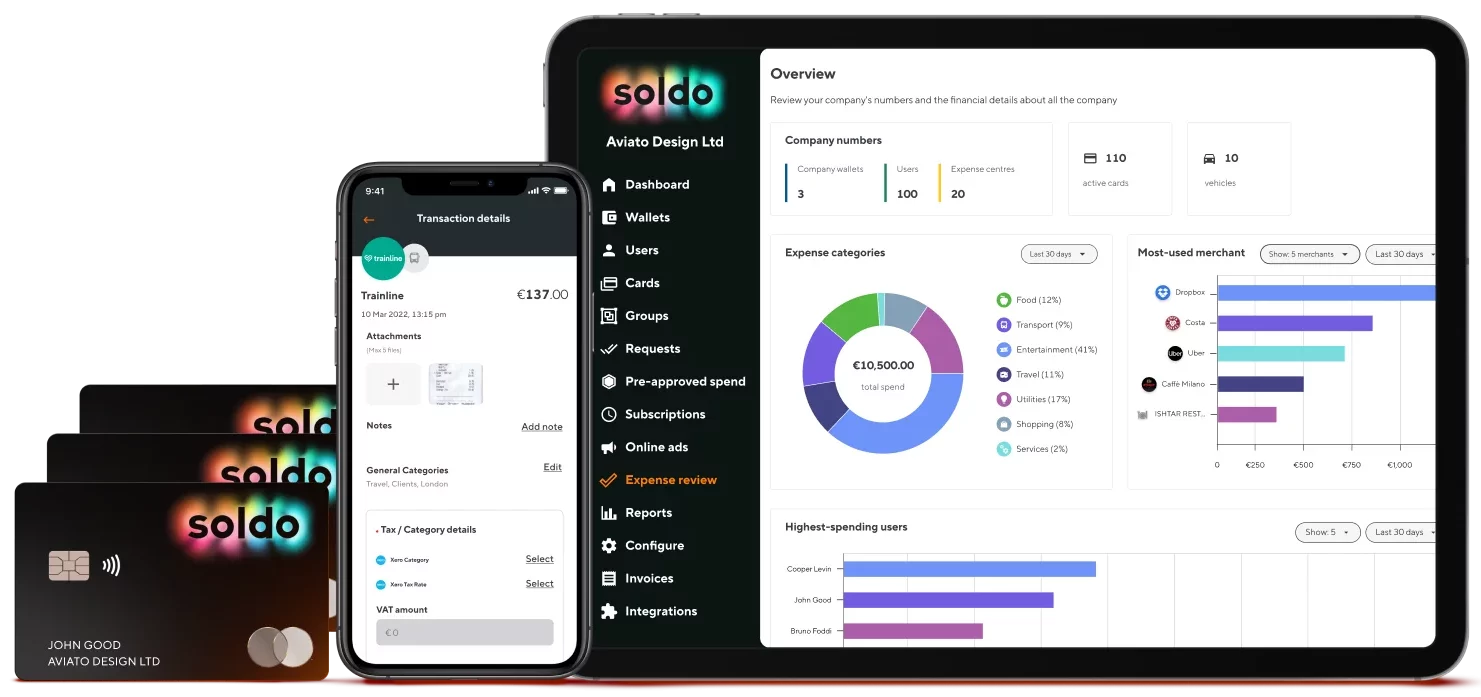

Is Soldo a bank account?

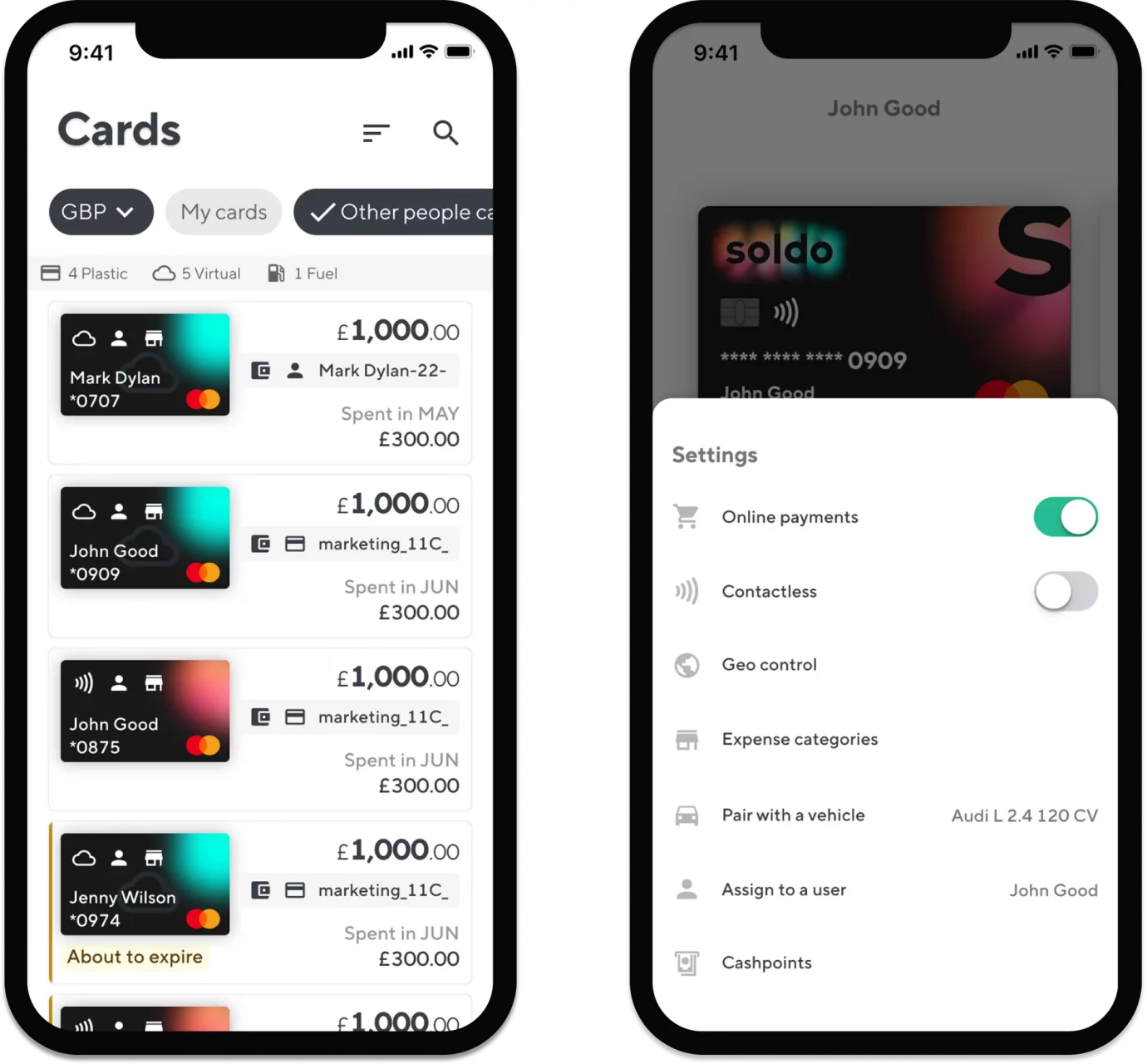

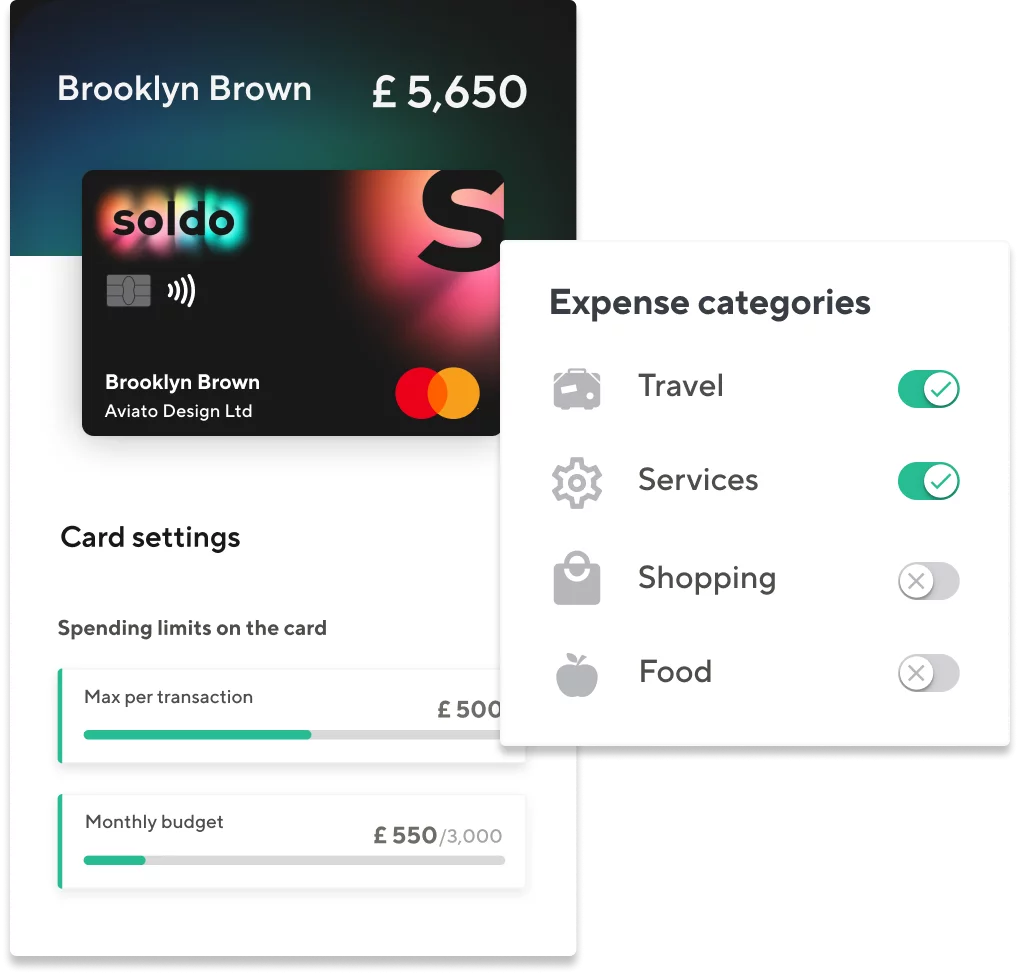

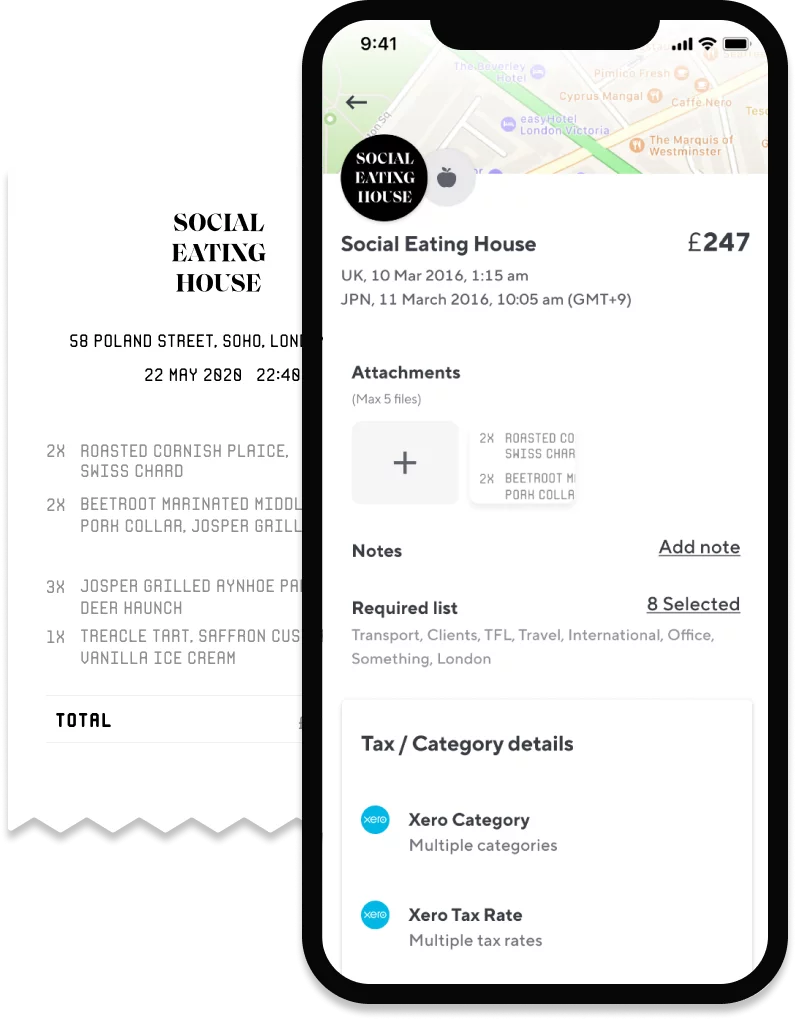

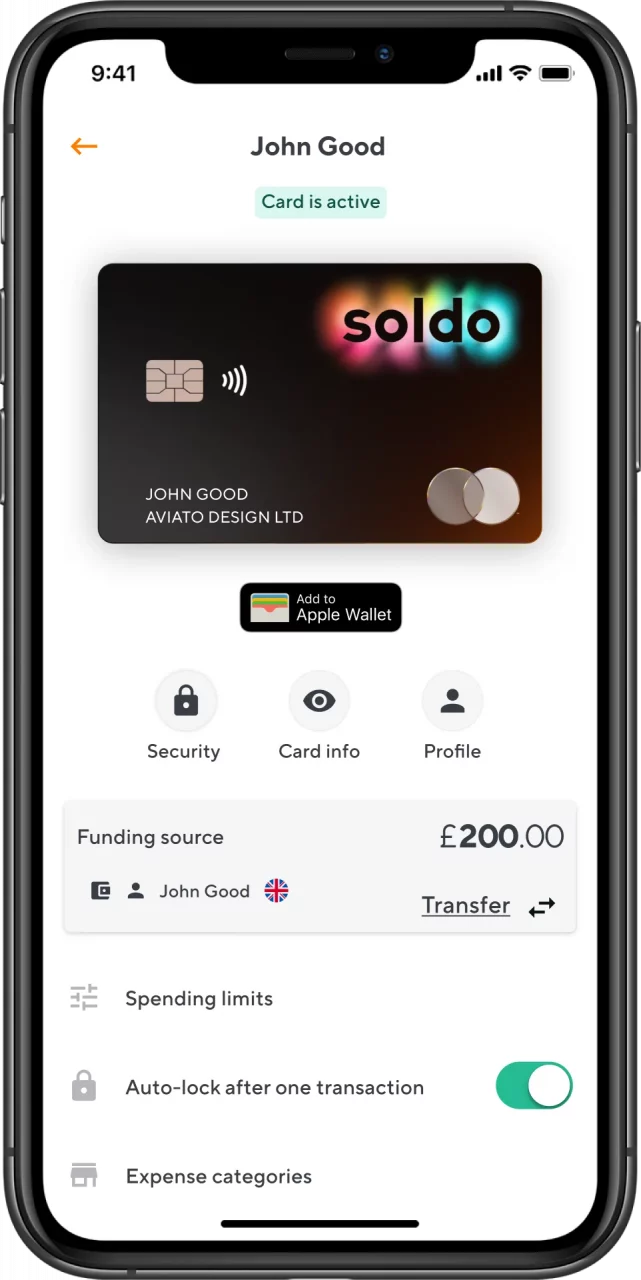

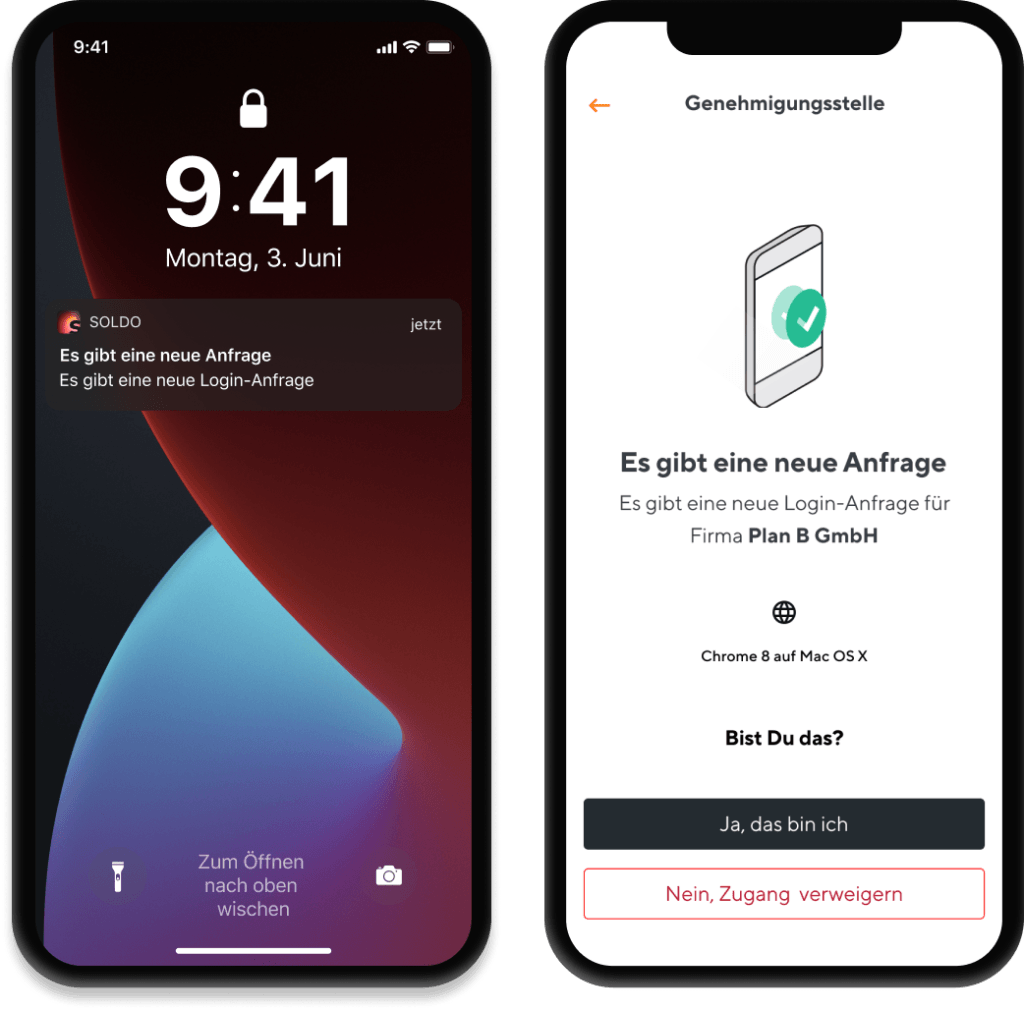

Soldo provides online expense accounts that sit alongside your business bank account, instead of replacing it. You can use your Soldo cards to silo staff spending from your main company funds, as well as access powerful new features that aren’t available with any banking provider.

How do I get more out of my business bank?

In traditional business accounts, money is held in a single pot accessed by just one debit card. Support for expense management and accounting processes is virtually non-existent. But there’s a smarter way. Soldo is the multi-user expense account that complements your business account. Soldo features advanced spending controls and captures rich data for simpler expense management and accounting. Just transfer funds from your business account to get going.