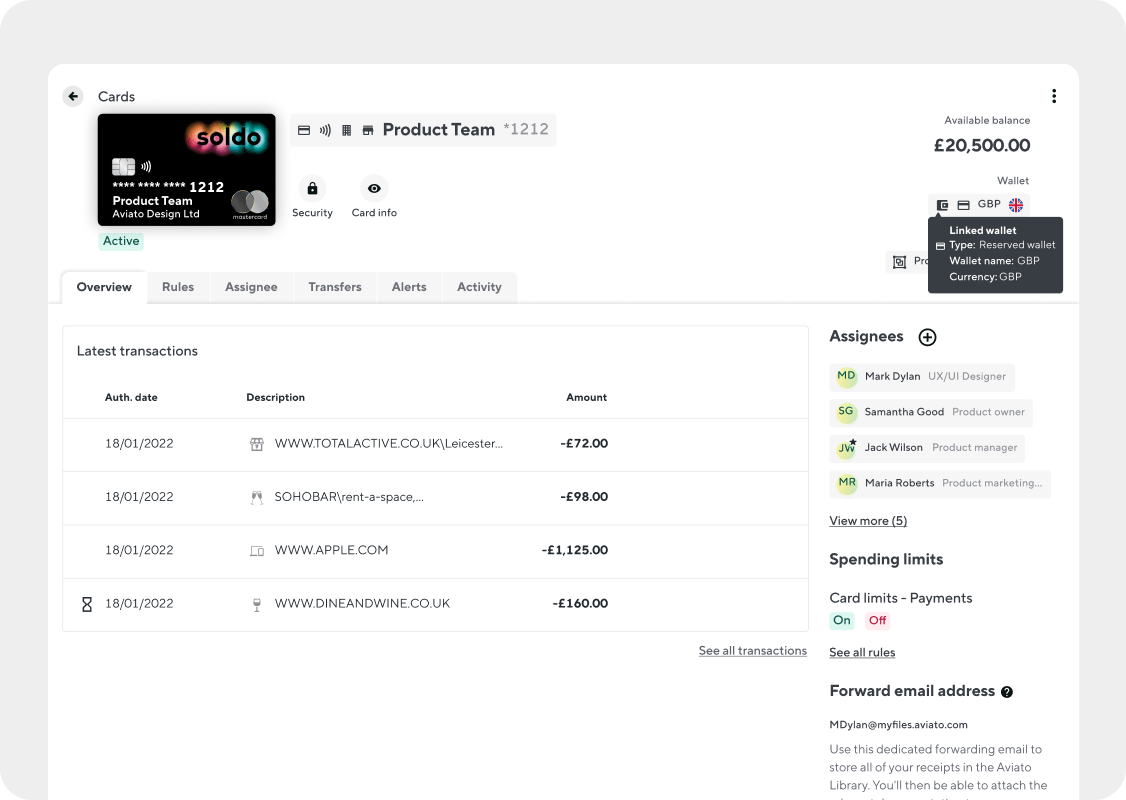

With Soldo company cards, you control your business expenses and who spends company money, how much, on what, and which budget they use.

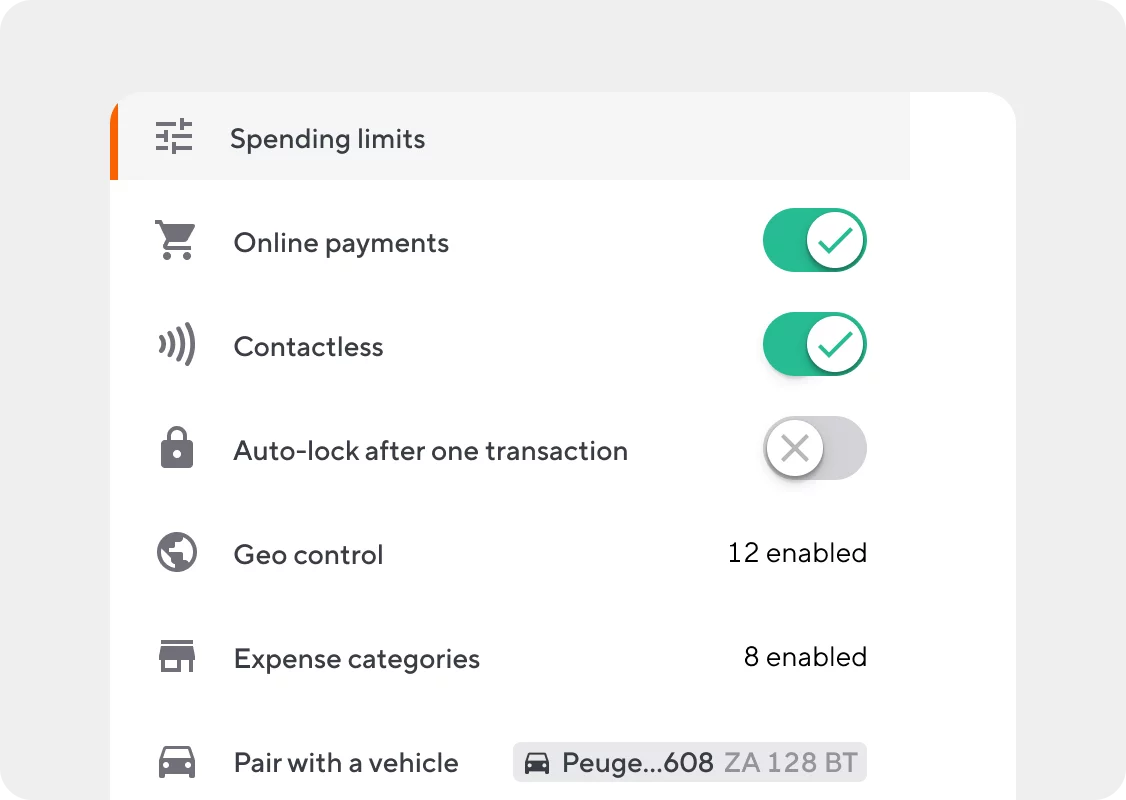

Set custom rules and limits for each card in a few clicks to prevent overspending , without micromanaging every transaction.

Prepaid cards give you effortless oversight and control over spending

Custom controls and real-time tracking mean you’ll never overspend again when you switch to Soldo.

Trust employees to spend company money with prepaid cards that keep you in control

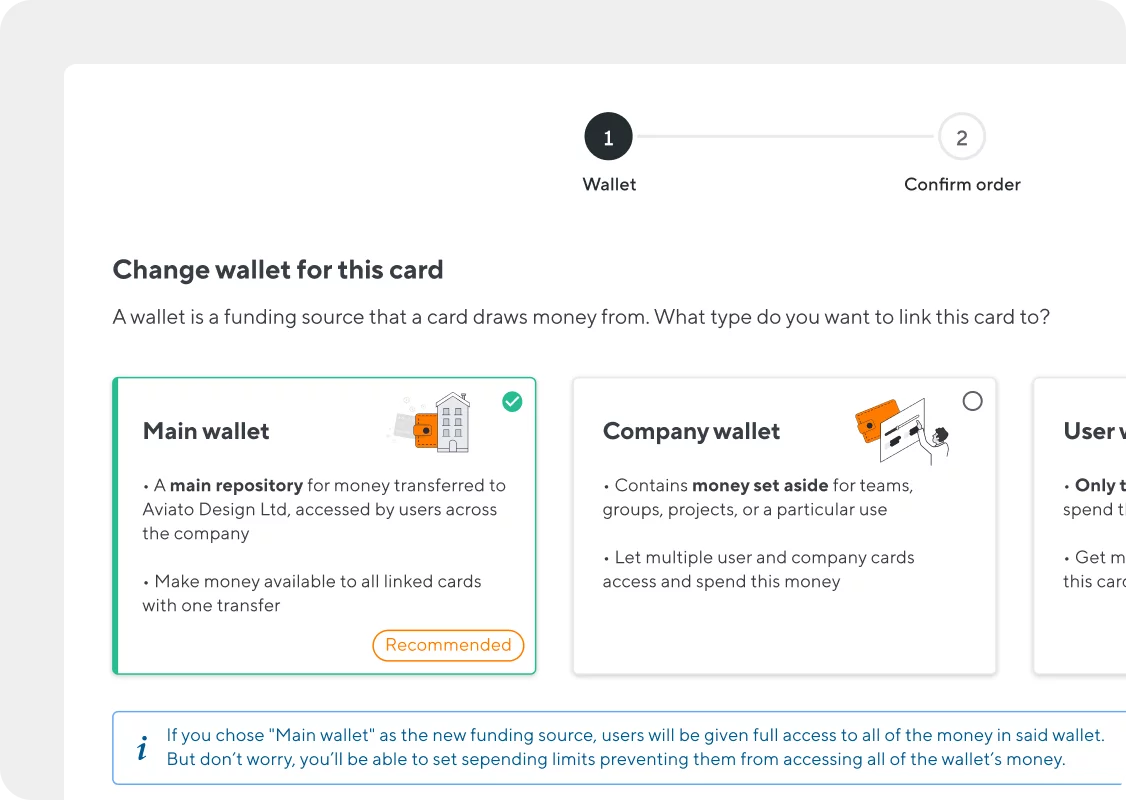

Separate budgets, custom limits and real-time visibility help prevent overspending

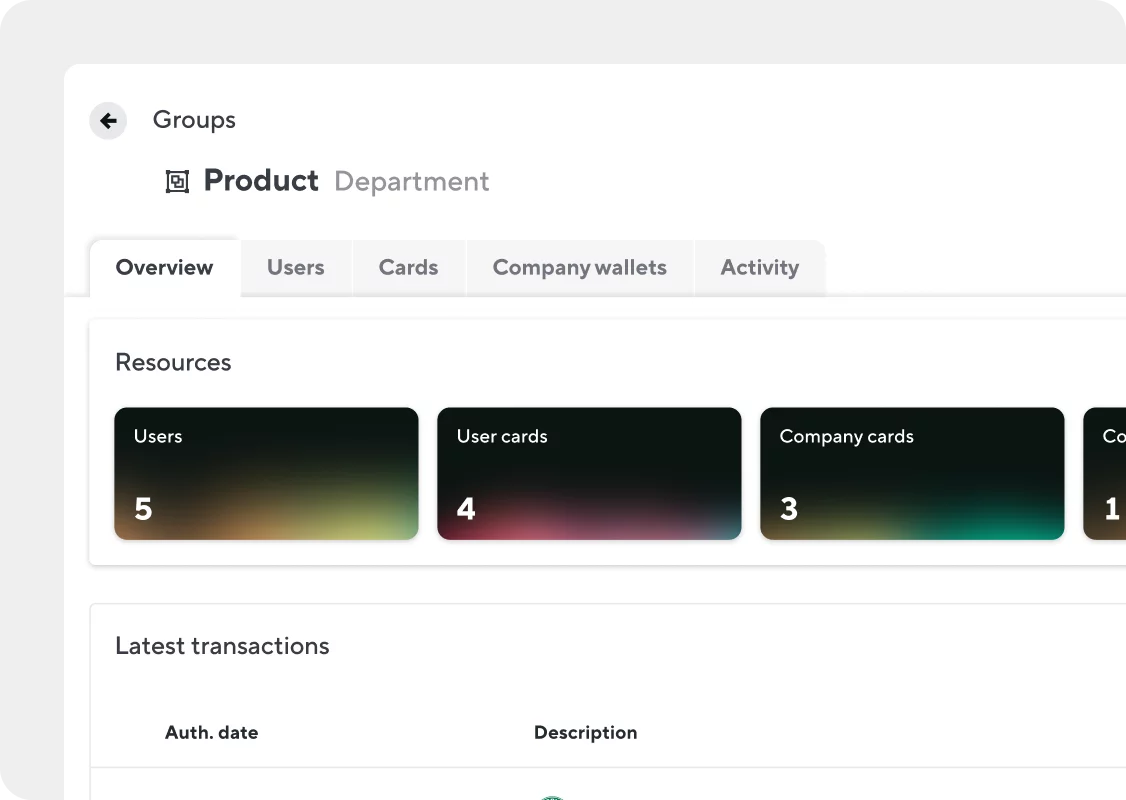

Save hours on admin and speed up month-end with automated tracking and reporting