How does Soldo work?

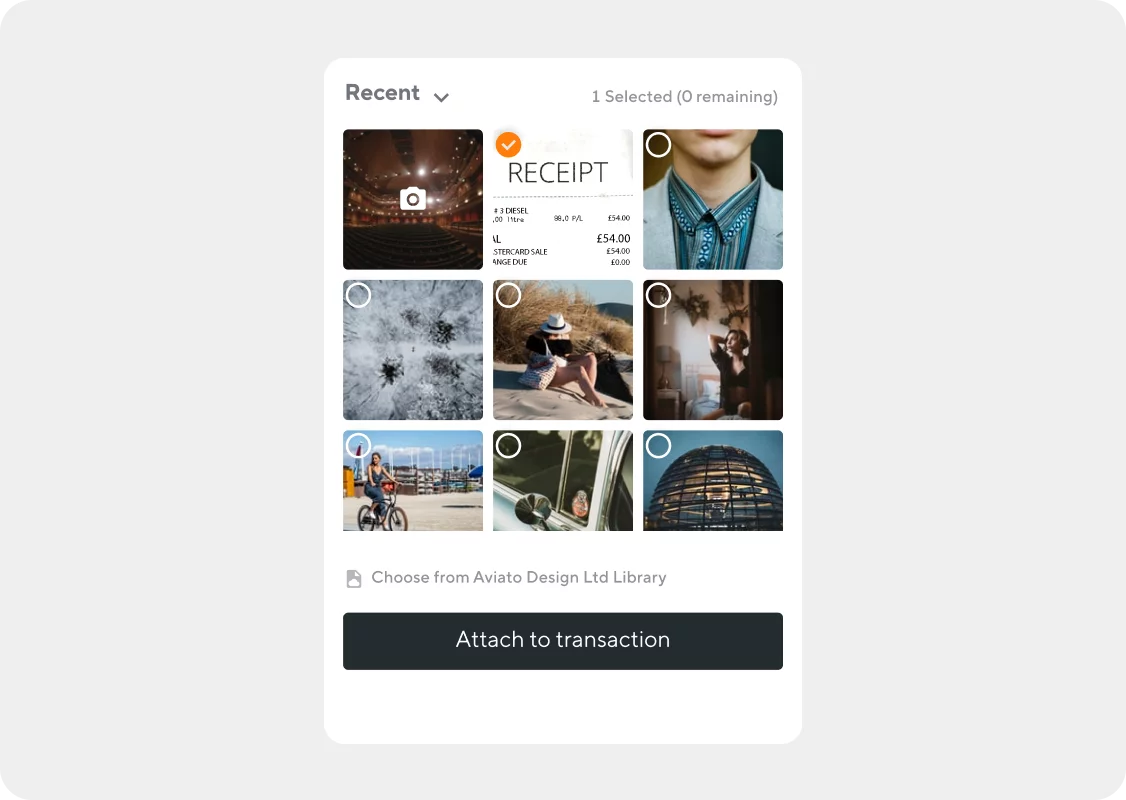

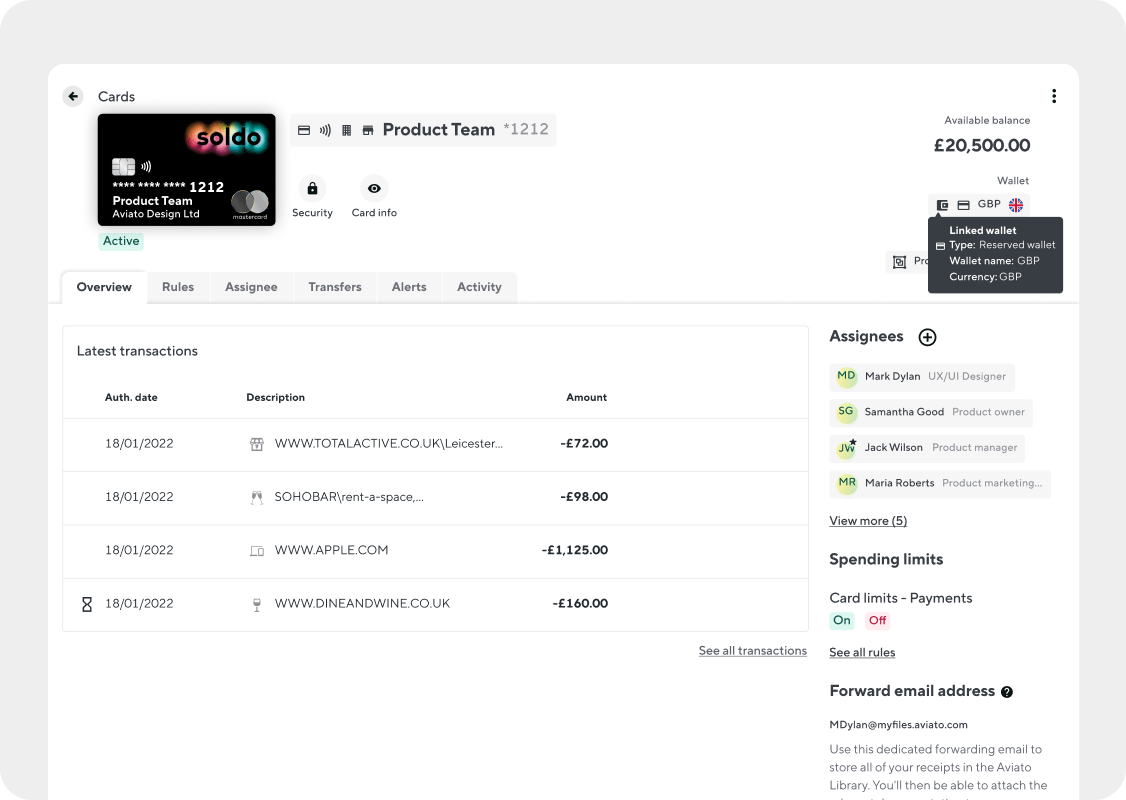

With Soldo, you control all business spending and – thanks to the integration with your accounting system – you can reconcile expenses quickly and easily. You can equip some or all employees, entire teams, or even external collaborators with Mastercard® Soldo cards , deciding who has access to company money and the rules by which to spend it.

Find out more

Is Soldo a business bank account?

No. Soldo provides additional spend management features that work alongside your business bank account, instead of replacing it. You can use your Soldo cards to separate staff spending from your main company funds, as well as accessing powerful new features that aren’t available with a traditional business bank account.

How secure is Soldo? What guarantees do I have?

Soldo Financial Services Ltd is an electronic money institution, authorised and regulated by the Financial Conduct Authority (FCA): this means we have to follow strict compliance processes. We don’t lend or take risks with customer money, we access it solely to execute the customer’s transactions. Client funds are always protected, as they are completely independent of Soldo’s business accounts and assets. The funds are safeguarded under UK Electronic Money Regulations 2011 and cannot be claimed by Soldo creditors.

Does Soldo integrate with my accounting system?

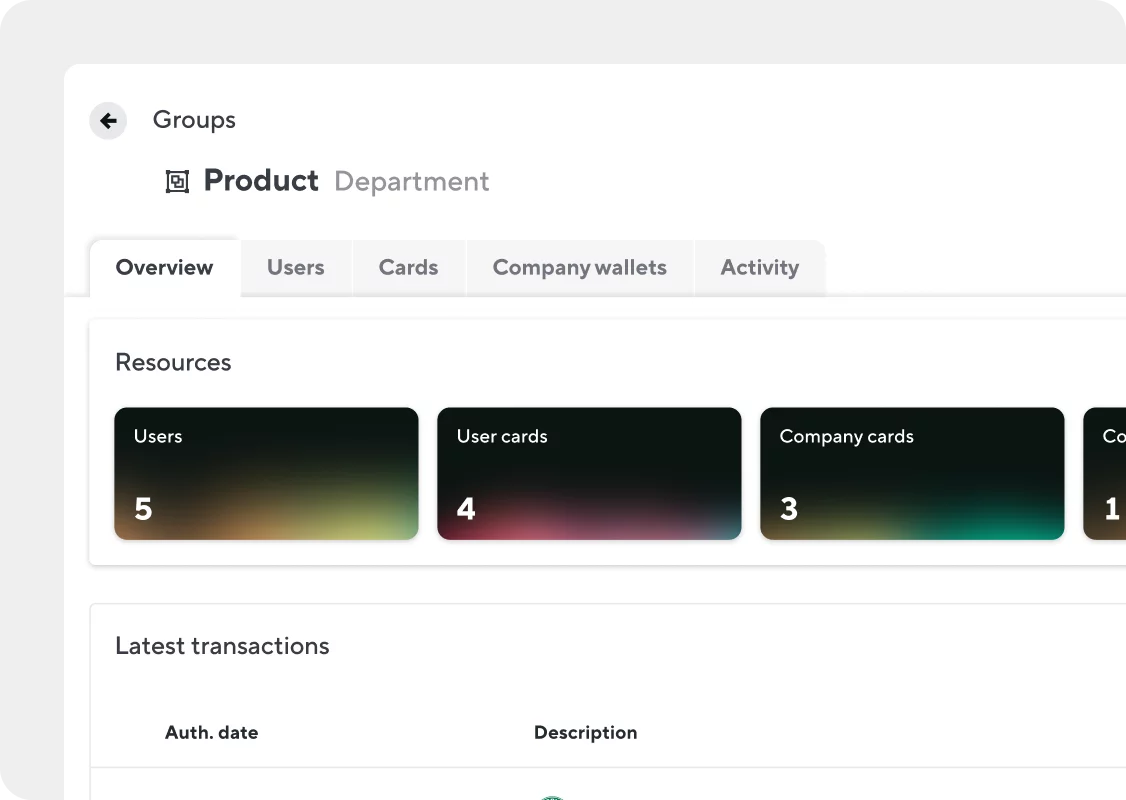

Yes, Soldo integrates with all major accounting systems. Soldo has the world’s most complete API connection to Xero, sending transactions daily via an automatic bank feed. Our seamless integrations with Xero, QuickBooks Online and NetSuite also make it easy to share enriched transaction data including receipts, categories, notes and much more – in just one click.

If you’re using another accounting platform – like Sage, FreeAgent or many others – Soldo makes it easy to export transaction data in a variety of formats, in two clicks. Transaction data can be exported in XLSX, CSV, QIF and OFX formats, making your data compatible with all major accounting software solutions.

What size company is Soldo suitable for?

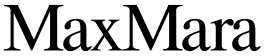

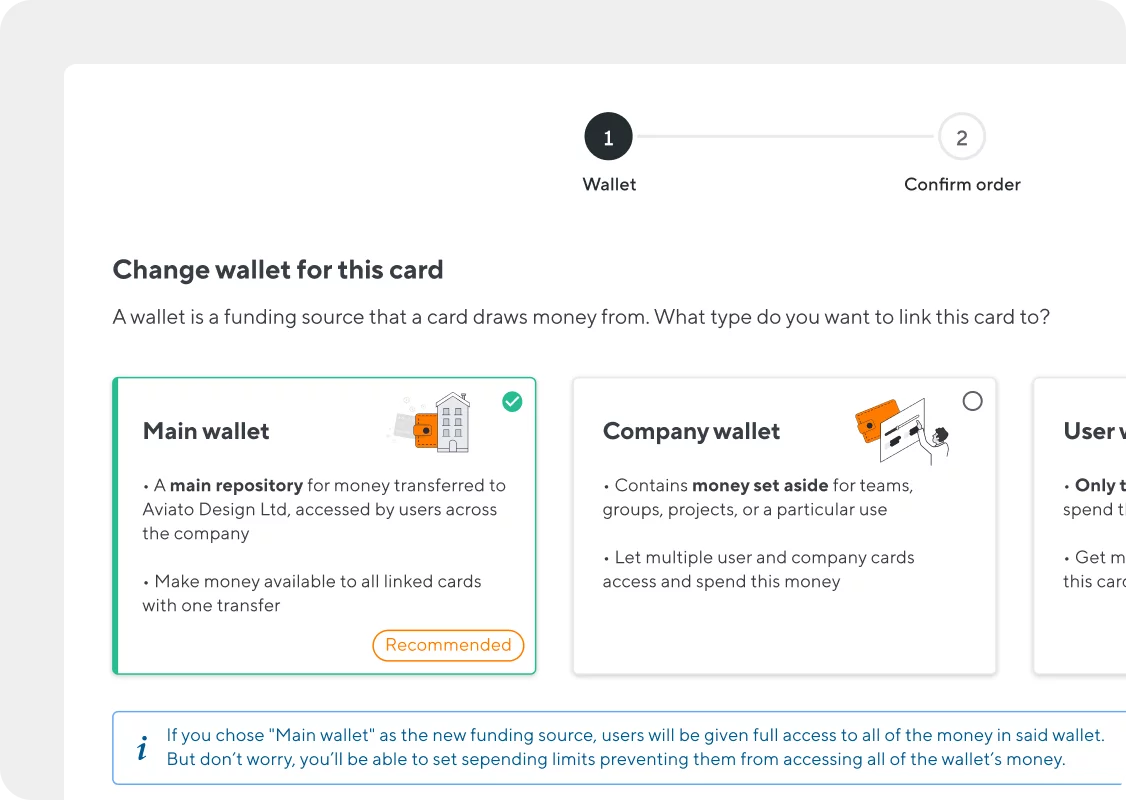

Soldo isn’t just for small business, it’s for all business. Soldo scales from one card to any number, matching the structure of your organisation with wallets for departments or individuals, which fund cards for teams, employees or contractors.

Though our software is intuitive and easy to use, powerful reporting is made possible by smart filters and granular transaction data. So, whether your business has two employees or 20,000, Soldo can help you gain visibility and control over spending, while simplifying expenses and helping you gain the advantages of financial planning in your business.

What if I want to leave Soldo?

We’re sure you’ll be happy with our service, joining thousands of satisfied businesses. But if you ever want to leave, you can close your Soldo account at any time and all the funds available on your account will be transferred back to the account from which they were initially deposited.