We’ve put together this handy guide to help you better understand HMRC’s rules around allowable expenses.

Every business has expenses

Whether it’s £500K worth of payroll and an office at The Shard, or a share of your home’s utility bills, every business has expenses. The good news is that HMRC lets you deduct some of these expenses — called allowable expenses — from your earnings. Which means you pay less tax.

The bad news is that not all types of expense are allowable. And the rules around this kind of expenses are tricky. So much so, that up to 60% of businesses under-report and pay more tax than they have to. With this in mind, we’ve put together this handy guide to help you better understand the rules around allowable expenses.

Read on to learn:

- Which business expenses are allowable (and which ones aren’t)

- How to keep records HMRC can’t argue with

- How Soldo can make expense management easy

What are allowable expenses?

Allowable expenses are costs that your business incurs that you can deduct from your earnings before you pay tax. For example, say your business makes £10k but you’ve spent £1,000 on expenses that are allowable, you would only be taxed on the remaining £9,000. This is a great way to save some cash, and could prove especially vital if you’re a small business. But this isn’t an automatic process. You have to know which of your expenses are allowable and keep records of them in case HMRC decides to check.

Which expenses are allowable?

An expense has to fulfil one central principle if it’s to be tax deductible: it must be “wholly and exclusively” for business purposes. This means that any purchase made with company money must not be for personal use. It must be necessary in the course of your duties, whether you’re a manager investing in new machinery or an employee buying office supplies.

Let’s say you need to order protective equipment for your staff. You wouldn’t have needed the equipment were it not for your business, so it passes the “wholly and exclusively” test and is an allowable business expense.

With some expenses it really is as black and white as that, but others are more complex. Either way, there are considerable benefits to be had.

Tax relief for businesses of every size

Although the allowable expense guidelines are the same for every business, some categories of expenses will be more useful to some than others. Here are a few examples of how your business can benefit.

Sole traders

If you work for yourself and have a home office, then you can claim tax relief on some domestic expenses. This will depend on lots of factors, from how many rooms your house has, to the cost of your bills. Once you calculate how much tax relief you’re eligible for, you could be in for a healthy sum. If you’re a sole trader, Soldo offers useful tools fro expense management when it comes to separating the personal and the professional.

Small businesses

If you own a small business then you’ll know that it doesn’t take long for the costs to start adding up. This is especially true when you first get started. Thankfully, you should be eligible for relief on a number of allowable expenses. These include advertising and marketing costs and charges associated with your business premises, like rent and utility bills.

Large businesses

Of course, large businesses can also benefit from allowable expenses like marketing costs and utility bills, but there are further allowances you could benefit from.

Although the “wholly and exclusively” rule is clear in most cases, and HMRC usually rule that dual-purpose purchases – meaning something bought for both personal and business reasons – are not allowable, there is one important exception.

Approved mileage allowance payments (or AMAPs) are flat rates that you can claim tax relief on when it comes to the mileage of personal vehicles that are used for business purposes.

There are lots of nuances around this topic, and you can read about them further in our mileage allowance guide, but the current rates are set at 45p per mile for cars and vans for the first 10,000 miles in the financial year, and 25p per mile after that.

For example, say your staff use their personal vehicles when they’re travelling on business journeys. The personal trips they take in that vehicle are of course ineligible for tax relief, but if the drivers keep detailed mileage logs and can show exactly how much mileage they racked up on business journeys and how much was for personal travel, then their business mileage is allowable.

This is because you can show that a definite proportion of the mileage was for business reasons. You can deduct a proportion of the business mileage, but not the personal mileage, from your earnings.

6 strategies to fuel growth in 2024

In this short summary, finance and business experts share 6 Growth Strategies from the 2024 Spring Budget to help your business grow.

Download nowWhat are disallowable expenses?

If expenses don’t pass the “wholly and exclusively” test, they’re disallowable. This means you can’t offset them against your earnings.

Some situations are obvious: it’s unlikely there’ll be a scenario in which your Netflix subscription is an allowable business cost. But things can get tricky when there’s a dual purpose, meaning the expense has both a personal and business element.

HMRC is clear that expenses with a dual purpose aren’t usually allowable if there’s no definite business proportion. In other words, if you can’t show exactly how much of an expense is business-related, you probably can’t deduct it.

On top of this, some larger items with considerable price tags, like computers, aren’t deductible as expenses. However, you can utilise what’s called an annual investment allowance. This allowance applies to anything that falls under the category of ‘plant and machinery’, and if your purchase is eligible then you’re likely to be able to deduct its entire cost before tax. This allowance was recently raised to £1 million. That’s a lot of machinery.

Keeping HMRC happy

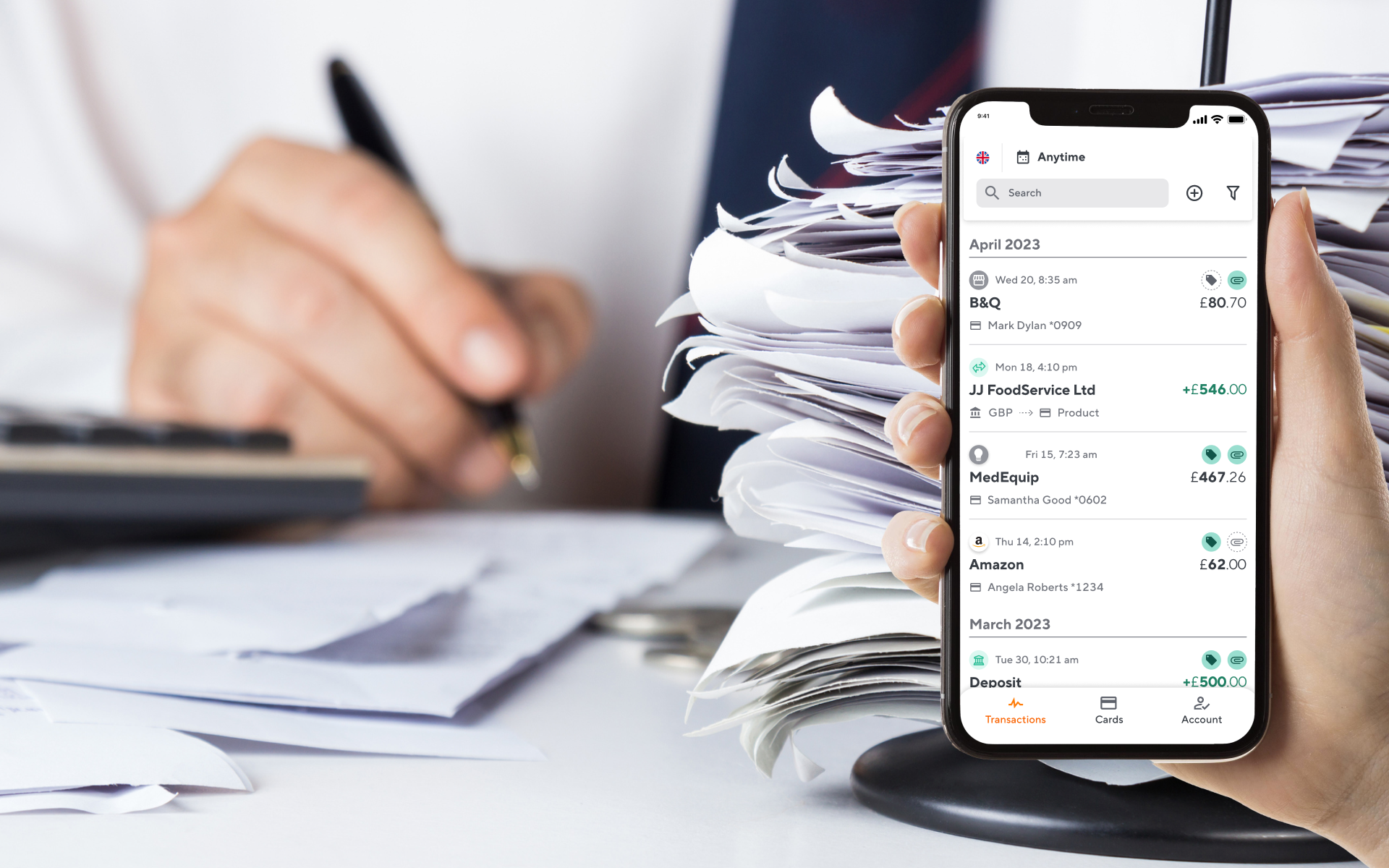

It goes without saying, but HMRC won’t take your word for it when you claim allowable expenses. They may ask to see proof.

This is why you need to keep accounting records, including expense receipts, for at least 6 years from the end of the financial year it relates to. So if you buy laptops for the business in 2022, or your employees need to make mileage claims, you need to keep receipts until at least 2028.

The upside is that there’s no need to keep paper copies of your receipts. There aren’t any rules around how you should store your records. HMRC requires that they are complete, accurate, and readable. This means you can store everything digitally if you prefer, and Soldo can help with that.

Allowable expenses: how Soldo can help your business track and claim back more

Soldo is the perfect partner for any business bank account, as our smart prepaid card system allows for comprehensive expense management, all in one place.

With expense management software that allows for complete security and visibility when it comes to spending, while making it easier for employees to make decisions.

Signing up is easy, simplify your expenses by upgrading to Soldo today.