Unlock flexible company travel

Every company with sales representatives, service teams, or employees attending events will incur business travel expenses. Often unexpected, last-minute, or high value, company travel expenses are a challenge to plan for, administer, and reconcile.

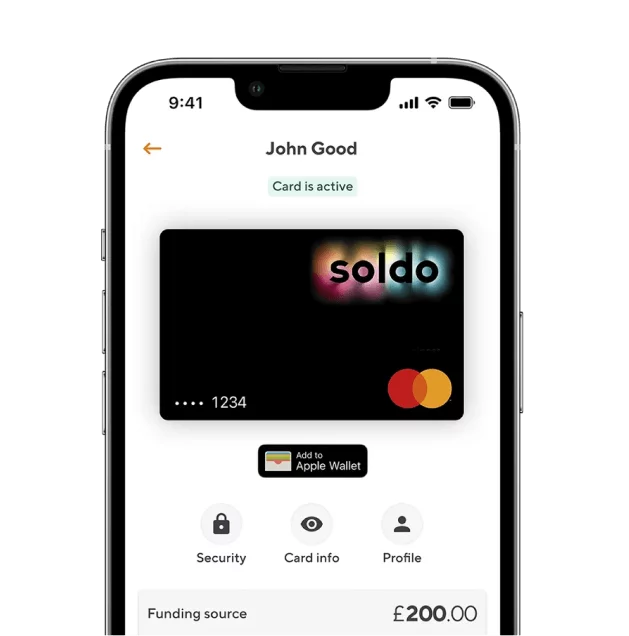

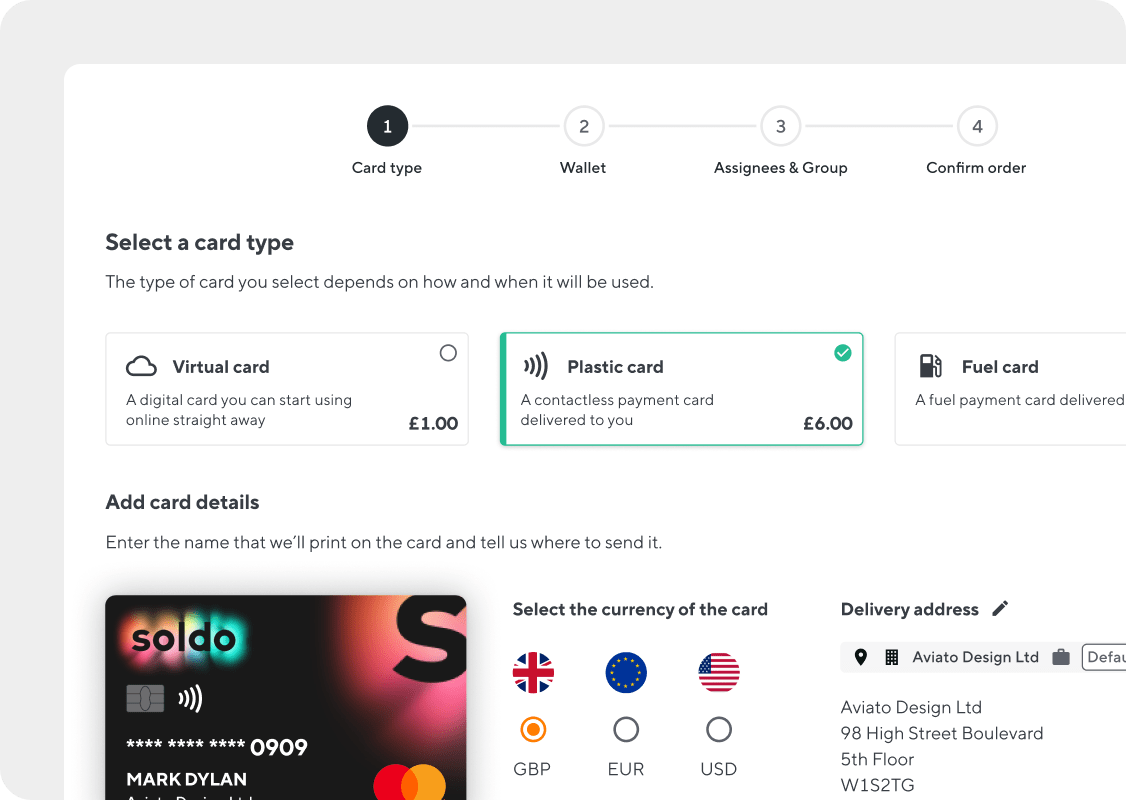

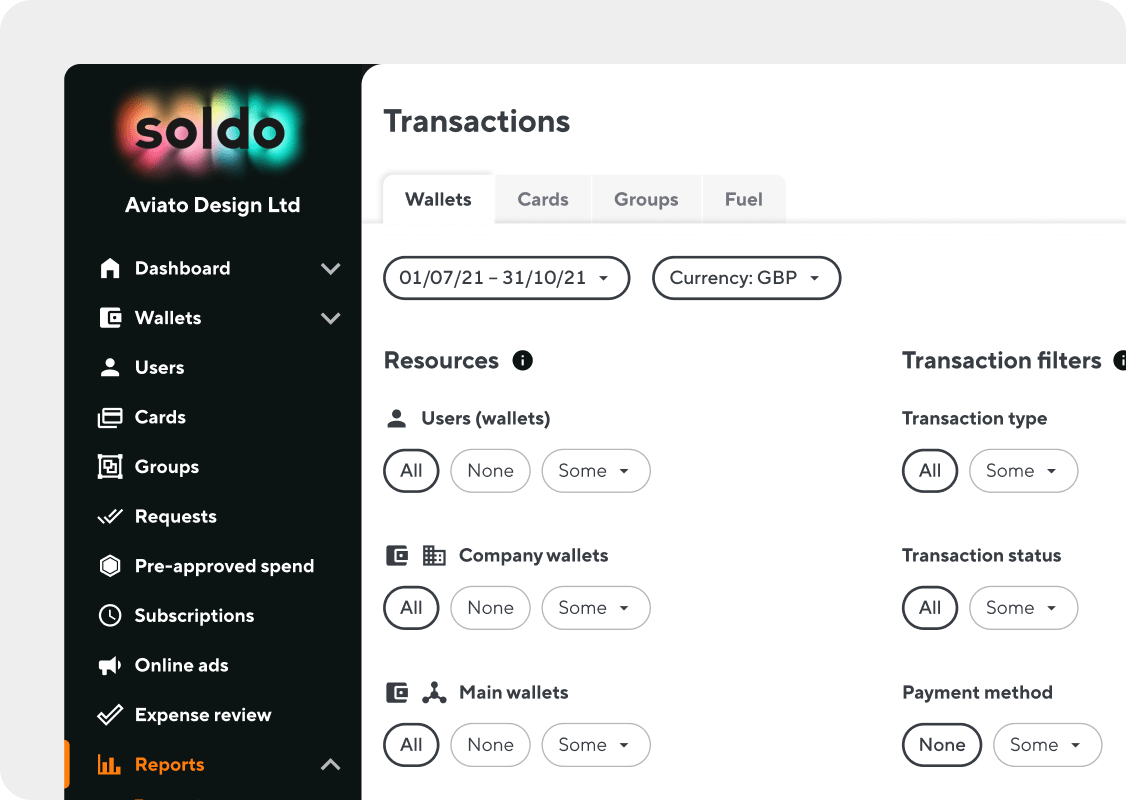

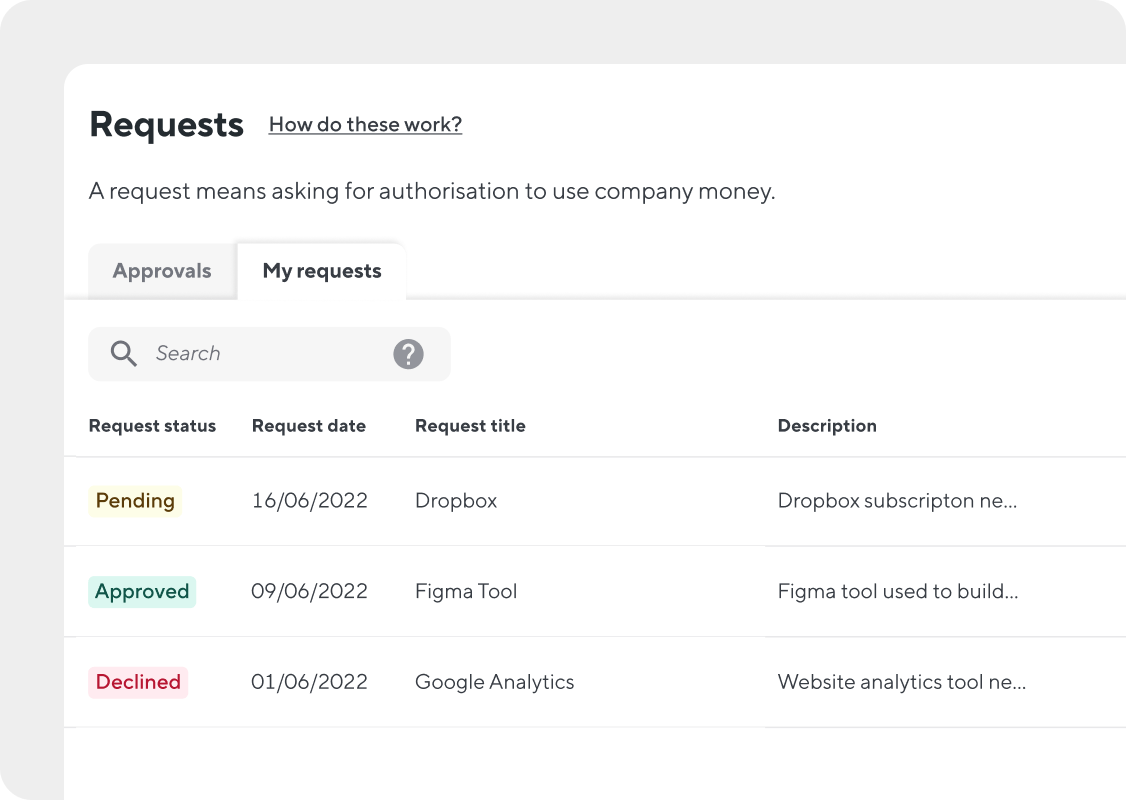

But Soldo’s cards and automated platform offer an easier solution, giving you everything you need to manage business trip expenses seamlessly.