What is a foreign exchange fee?

A foreign exchange transaction fee, or an FX fee, is the extra cost of making a transaction in a different currency. It might also be incurred when a purchase goes through a foreign bank.

Most cards, even FX business cards, incur some level of a fee because of costs incurred to the provider. For credit and debit cards, this can be particularly high, but even for most FX cards, it is usually around 3% of the value of the transaction.

Thankfully, Soldo’s fees are lower than most, and you can compare Soldo plans here.

What is the difference between a prepaid currency card and a credit/debit card?

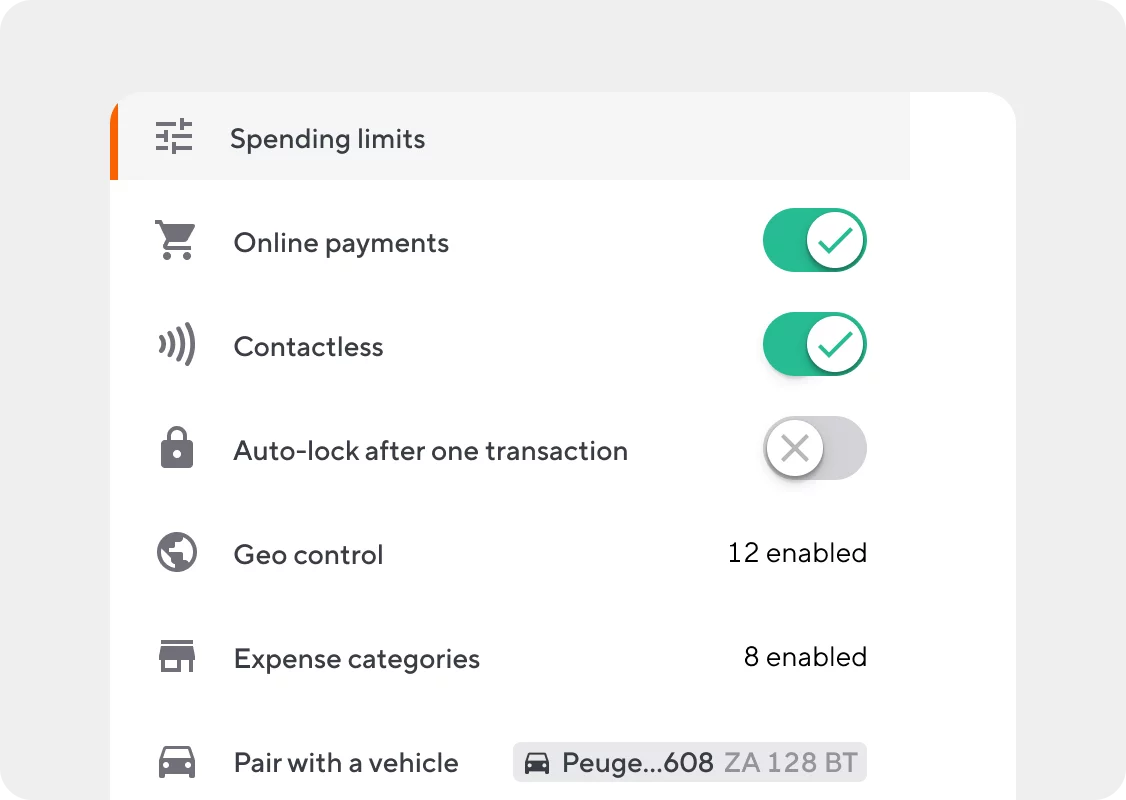

With a business debit card, the balance is directly linked to the bank account itself, so there’s no way to limit a cardholder’s spending. In theory, they’re able to use the card until the account is empty.

Business credit cards are even less prohibitive. Team members can essentially spend what they like (up to the credit limit), and you’ll need to pay off the debt at the end of the month. If you don’t, you risk having to pay lots of interest and damaging your business credit score.

Both come with high FX fees, though these vary depending on which provider issues the card. This makes them impractical for business trips. But prepaid cards can provide a much smarter alternative to credit and debit cards.

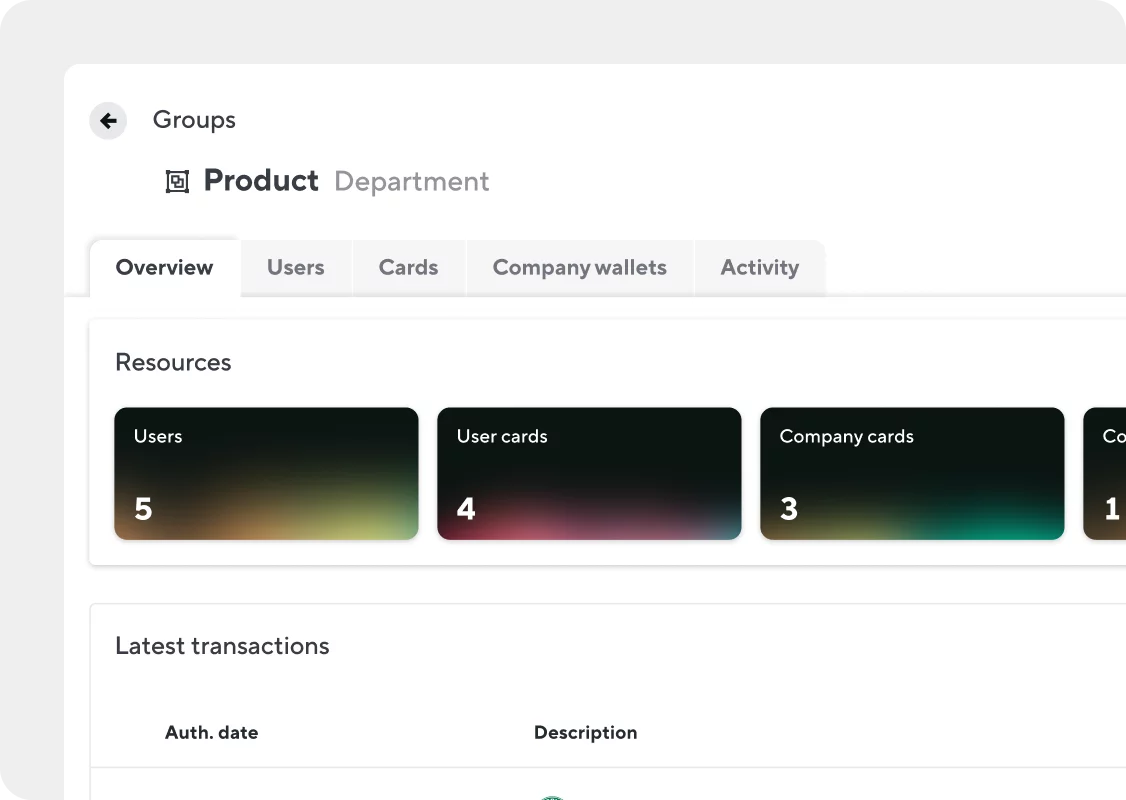

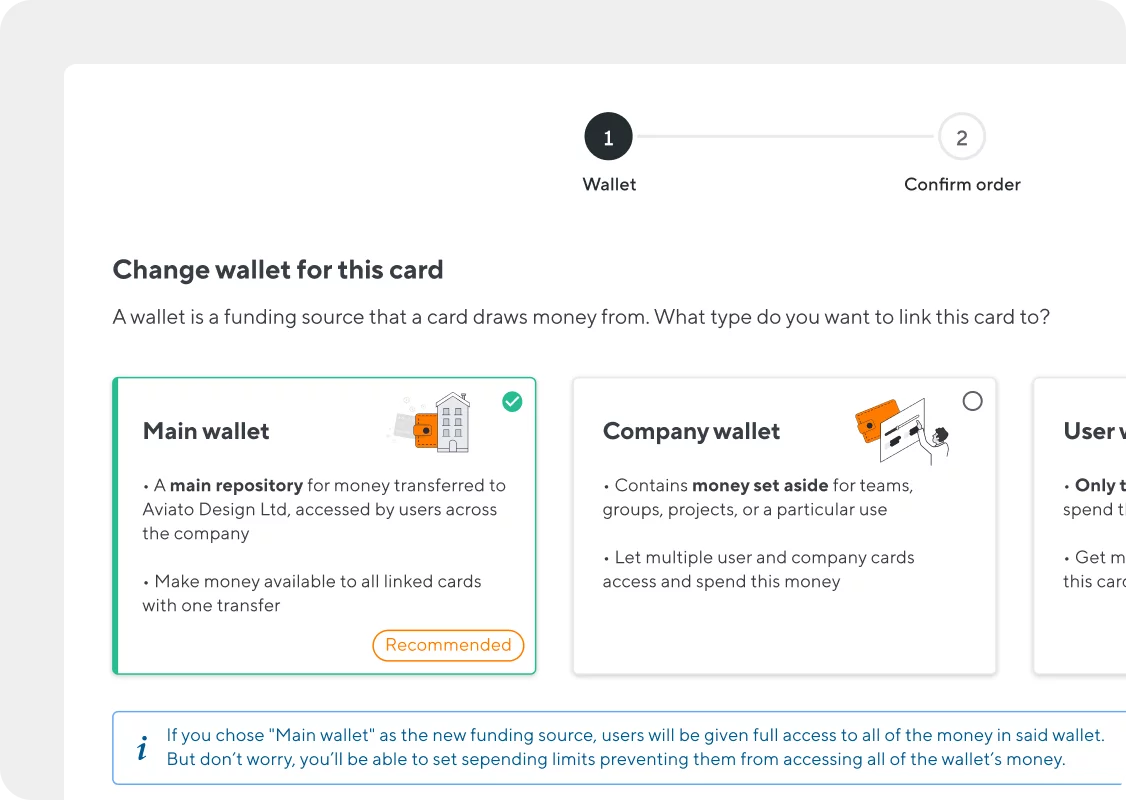

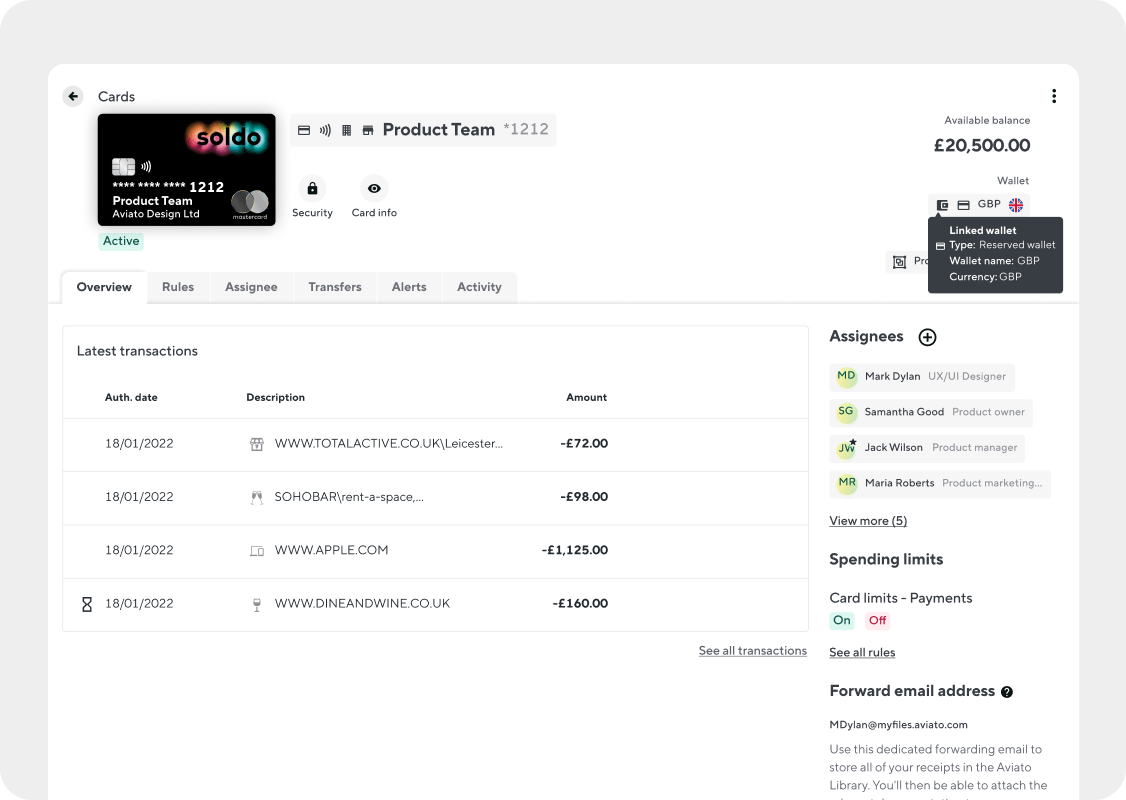

A Soldo card gives you the best of both worlds with none of the drawbacks. Not only can you use it abroad with a lower fee than most FX cards, and not only can you use it on home soil, you also have significantly more control over how much cardholders can spend.

Is a prepaid travel card right for my business?

A prepaid travel card is well worth having if your team travels for business. Otherwise, fees will start to add up.

They’re useful for startups and SMEs because there’s no need to establish a strong credit score before you apply. They’re also great for large businesses because you can have numerous cards in circulation at once without giving up any control, meaning you can hand them out to individual departments, contractors, and freelancers.

Do prepaid currency cards work with accounting software?

Many card providers don’t offer the data management capabilities needed to integrate with popular accounting software.

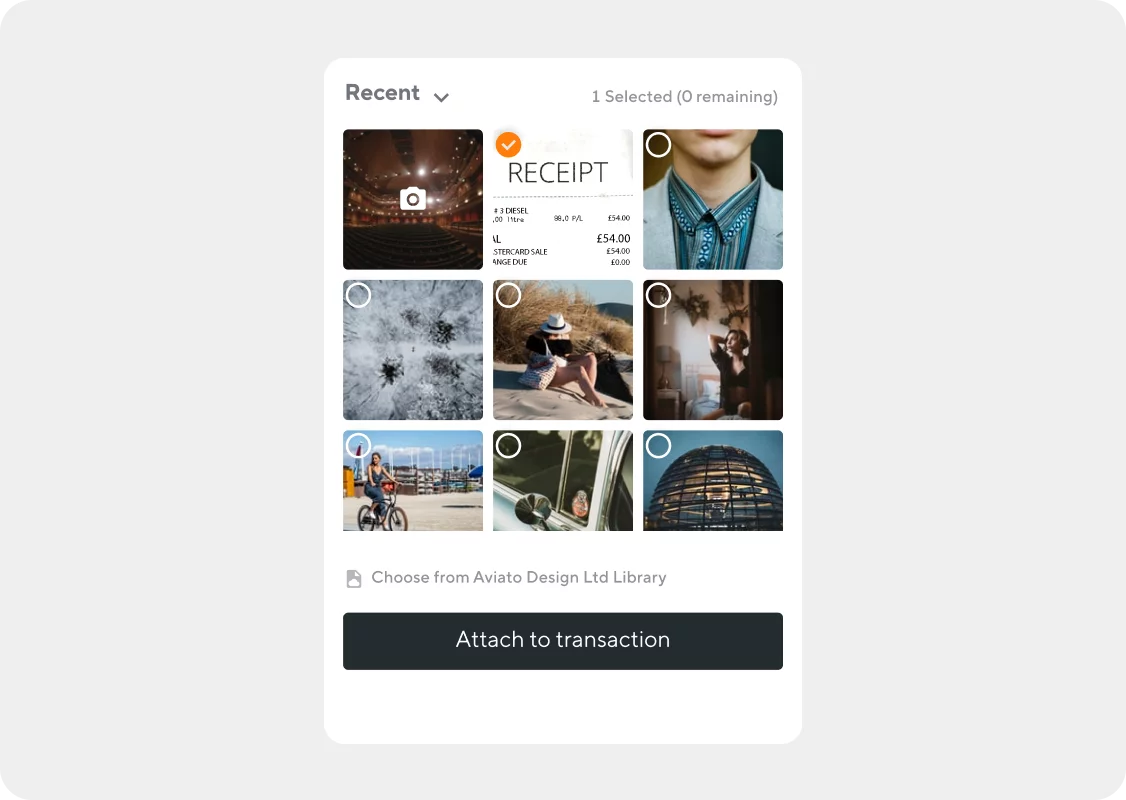

But Soldo is different, and our functionalities include accounting integration. In practice, this means you can export transaction data to QuickBooks and other accounting apps at the touch of a button.

Do I need a credit check for an FX business card?

No. FX business card providers may ask you for a few details when you sign up, but not for your credit history.

So if you haven’t had a chance to establish a credit score, or if you’ve had problems in the past, it won’t matter. Just remember that you also can’t improve on your existing credit score with an FX business card. With Soldo you can sign up in minutes with no need for a credit check.

What are some alternatives to prepaid currency cards?

Credit and debit cards

Credit and debit cards are a popular choice, but they come with substantial fees and charges for foreign payments. And because there’s no option to set rules and limits, they’re also difficult to manage.

Out-of-pocket payments

One alternative involves staff covering their own expenses and claiming the money back at the end of the month. But this can be expensive in the short term, and problematic for those who can’t afford it. And when it comes to the claims, it can be hard to make sure they’re getting recompensed for transaction fees as well.

Petty cash

You can use petty cash to cover small ticket items. But in reality, it won’t go very far on a business trip. And since you don’t know who’s spending what and where, you’ll likely lose track of it, too.

What do I do if my card is lost or stolen?

With many card types, you’ll need to get in touch with the provider so they can cancel it for you. But with Soldo, you can switch the card off at the touch of a button. Our intuitive mobile app allows you to control every single card all in one place, including whether those cards are active or not.