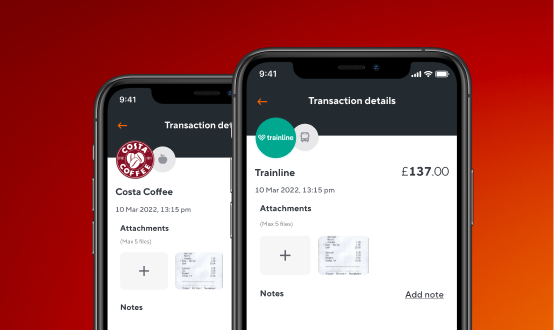

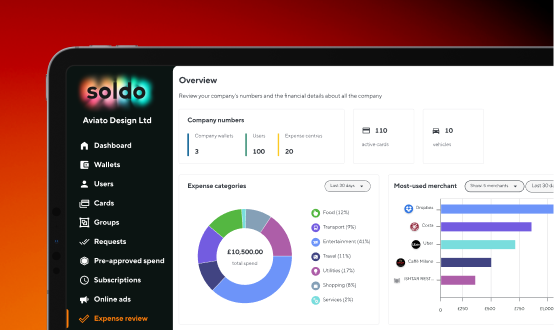

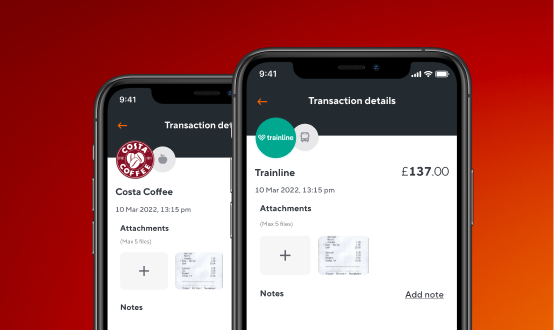

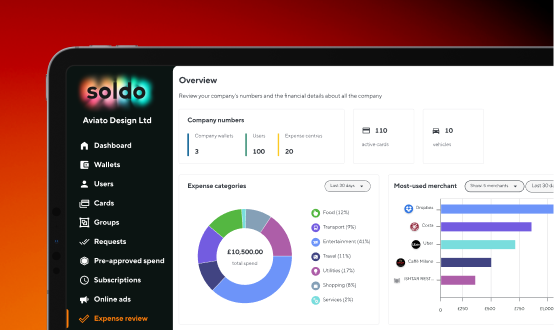

Take control of every expense, in one platform. Manage out-of-pocket expenses, set up spending policy allowances, and speed up reporting and expense reviews.

Many businesses are still using manual processes – including petty cash and reimbursements – to manage expenses. These systems can’t give a full picture of spending and slow teams down with hours of paperwork. But there’s a better way. Download our free guide to find out more.

Get your guide

Join 30,000+ businesses who’ve already made the switch.