Everything you need to know about HMRC mileage allowance, and how Soldo can make this process easier for your finance team.

If you have to travel for work, or you’re a business owner whose employees travel for work without a designated fuel expense card you may be asking how you can get some of the travel costs incurred reimbursed. Thankfully, once you’re familiar with a few guidelines set out by HMRC, calculating mileage allowance is easy, and you can start saving a substantial sum of money each tax year.

If you or your employees are using a personal vehicle for purposes relating to your business, then you can claim back a certain amount of what has been spent, tax free. HMRC have a flat rate per mile, depending on the type of vehicle you’re using and how far you travel in the tax year. This rate is known as an Approved Mileage Allowance Payment rate, or AMAP, and to claim it, the journey absolutely must be business-related.

But when is a journey considered business-related? There are two main criteria that tell you whether a journey will qualify for an AMAP. Either the trip is necessary to carry out the employee’s professional duties, for example travelling to a client’s place of work, or to a conference. The second option is that the employee needs to travel somewhere other than their usual workplace for their job.

The current rates are set at 45p per mile for cars and vans for the first 10,000 miles in the financial year, and 25p per mile after that. For motorbikes the rate is 24p, regardless of distance, and for bicycles the rate is 20p, also regardless of distance.

So for example, if an employee travels 13,749 miles in a tax year, you would calculate the mileage allowance by multiplying 45 pence per mile by 10,000, and then 25 pence per mile by 3,749, and adding those figures together. So for that year the employee would be eligible for £5,437.25.

On top of this figure, an extra 5p can be claimed for each passenger in the car, providing that the passenger in question works for the same company and it is also necessary for them to undergo this journey as well.

The rate covers the cost of owning and running your car. It’s an all-encompassing figure and you can’t claim separately for business expenses like fuel, repairs, MOTs, or road tax. It’s also important to note that this rate is calculated per employee, not per vehicle.

It’s important to reiterate that AMAPs only apply to the use of a personal vehicle for business purposes. There are different rules for company cars, and HMRC publish Advisory Fuel Rates for this purpose, which are reviewed quarterly. As the name suggests, these rates are advisory, and are therefore less concrete than AMAPs. They’re based on engine size and fuel type and will vary depending on the specific company vehicle.

To be eligible for a business mileage allowance, you just need to be able to prove that your journeys are business-related. Although it’s important to stress that your commute to your usual workplace is not considered when calculating your allowance. This daily travel is classed as ‘ordinary commuting’ by HMRC and you can’t claim on it. However, if your workplace is ‘temporary’, this changes, so this is definitely something to remember.

You may have heard of something called the 24-month rule. This refers to the distinction between a permanent workplace and a temporary workplace. Although you are unable to claim mileage allowance on any travel to and from a permanent workplace, you can claim on travel to a temporary workplace, as this counts as an individual travelling away from their usual workplace for their job. A workplace only counts as temporary if you’ll be working there for less than 24 months, hence the name.

Once you’ve considered all of these factors and you know where your travel habits fit into HMRC’s guidelines, you’ll be able to calculate your business mileage, and therefore your mileage allowance payment with ease.

It’s very important to keep an accurate picture of the mileage rate, as HMRC are not shy about handing out fines if you’ve claimed for more miles than is correct, or for a personal rather than business journey. You will need to log the date of the journey, the total distance travelled, and the journey’s purpose. This can lead to a large volume of admin for your finance teams which can be time consuming and distract from more important tasks.

Some business owners use fuel cards to manage their employees’ mileage costs. This can be beneficial as it means staff don’t need reimbursing, and some fuel cards come with functionalities such as mileage tracking and discounted rates on fuel.

However, because you can only use most fuel cards to pay for fuel, other costs such as road tolls, meals, and parking charges need to be paid for another way. This of course means even more admin.

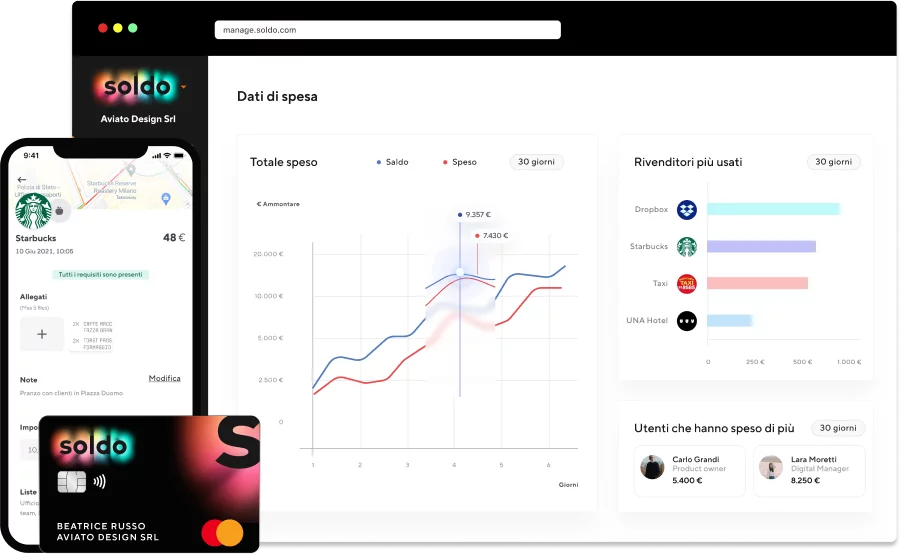

Soldo is a smart prepaid system that will enable you to optimise your finances and keep a close eye on your employees’ spending, so you never have to go through long stretches of time balancing the books. Assign prepaid cards to your employees and establish budgets so you know exactly how much is being spent and when. And this spending isn’t limited to just one thing.

With mileage allowance, it’s important to keep track of exactly how far a journey is and when it occurred. Soldo makes this easy. With the Soldo expense management software can see what your employees are spending in real-time, and have that data integrated directly with accounting software such as Xero and QuickBooks Online.

Employees can simply upload receipts to our intuitive expense app and instantly connect them to a specific transaction. This way, your business expenses are automatically tracked and expense reporting becomes much more simple.

Never worry about employee spending becoming unmanageable again, with Soldo you can have peace of mind and keep control of your finances at your fingertips.

Soldo helps you simplify the management of business expenses by making administrative processes faster and more transparent.