Give a card, get spending

Whether it’s physical or virtual, for regular or infrequent spenders, Soldo company cards let you trust all your employees to spend company money when they need it.

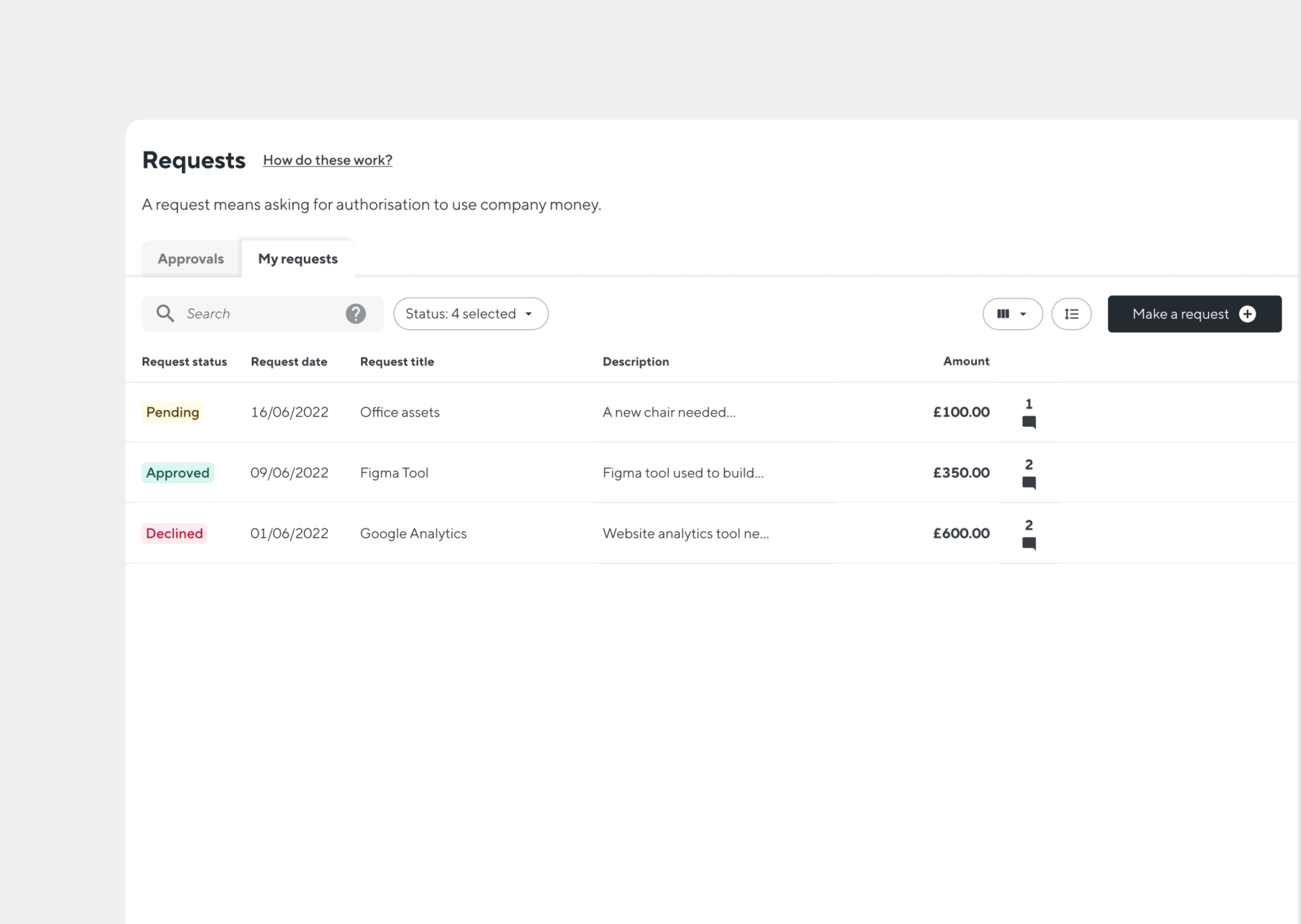

Request and action

Using our mobile app, employees can upload expenses and justify them, make requests to get their cards topped up or to make an ad-hoc purchase. Approvers are notified of these requests so they can action them quickly, even on the go.

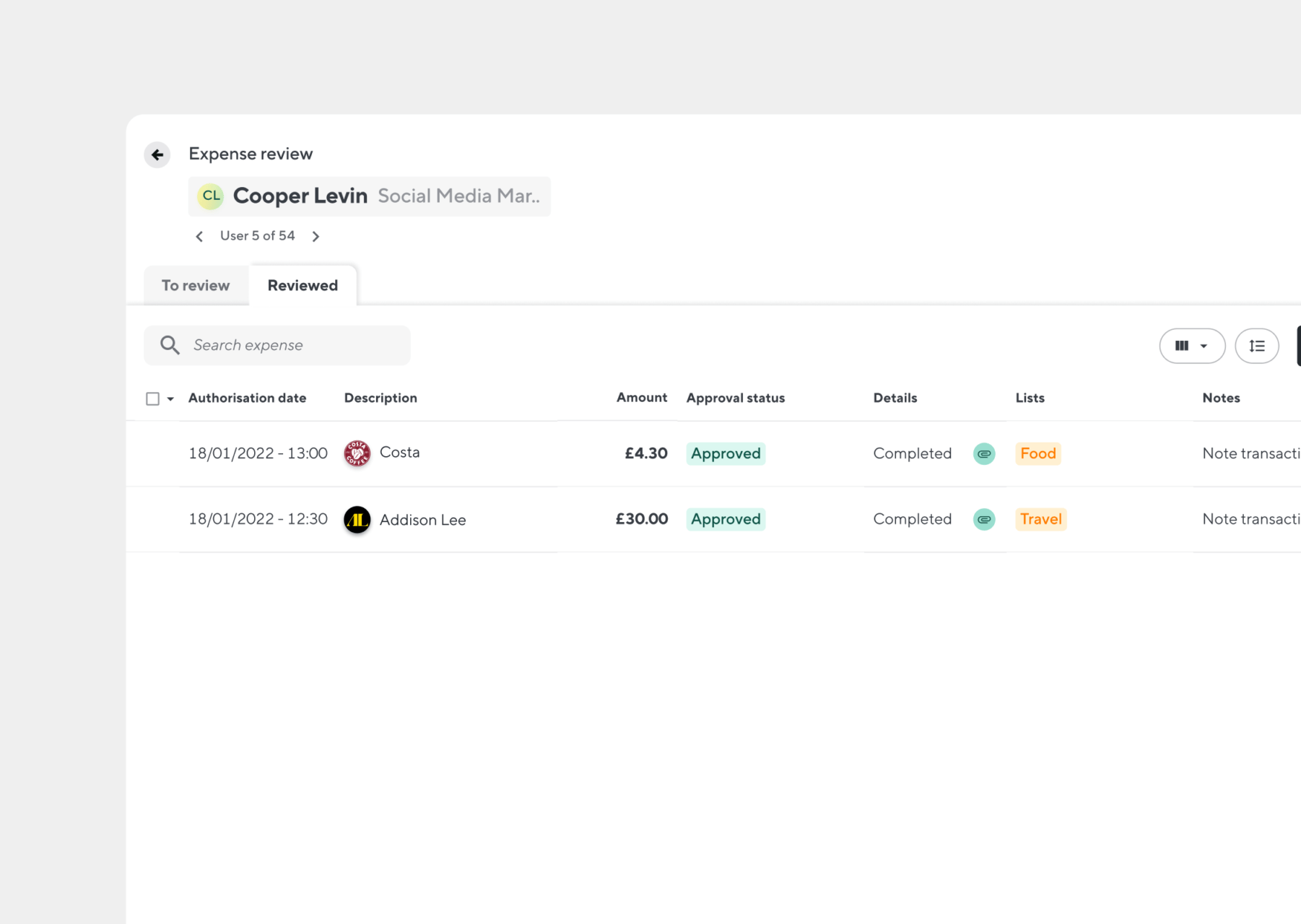

Review and reimburse expenses

Create a simple approval process so the right person approves the right expenses, and all spending is in policy. For any out-of-pocket expenses, you can quickly and easily reimburse employees through Soldo.

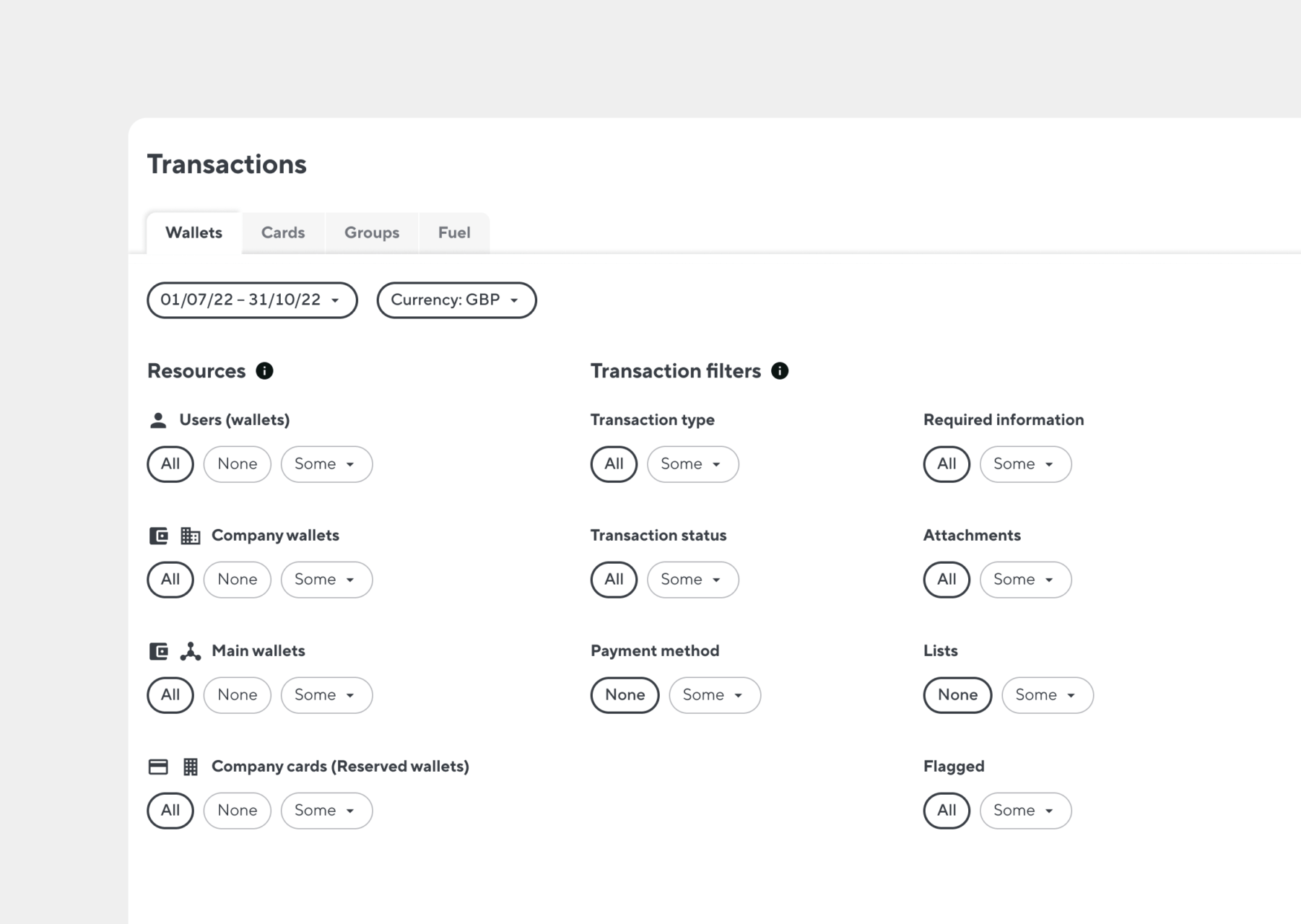

Report and analyse

Analysing your business spending each month can be easy. Create category types so your payments can be categorised and generate the expense reports you need, including detailed views on subsets of data such as reimbursements or fuel. Expense data can be archived so it’s available when you need it for audits or compliance needs.

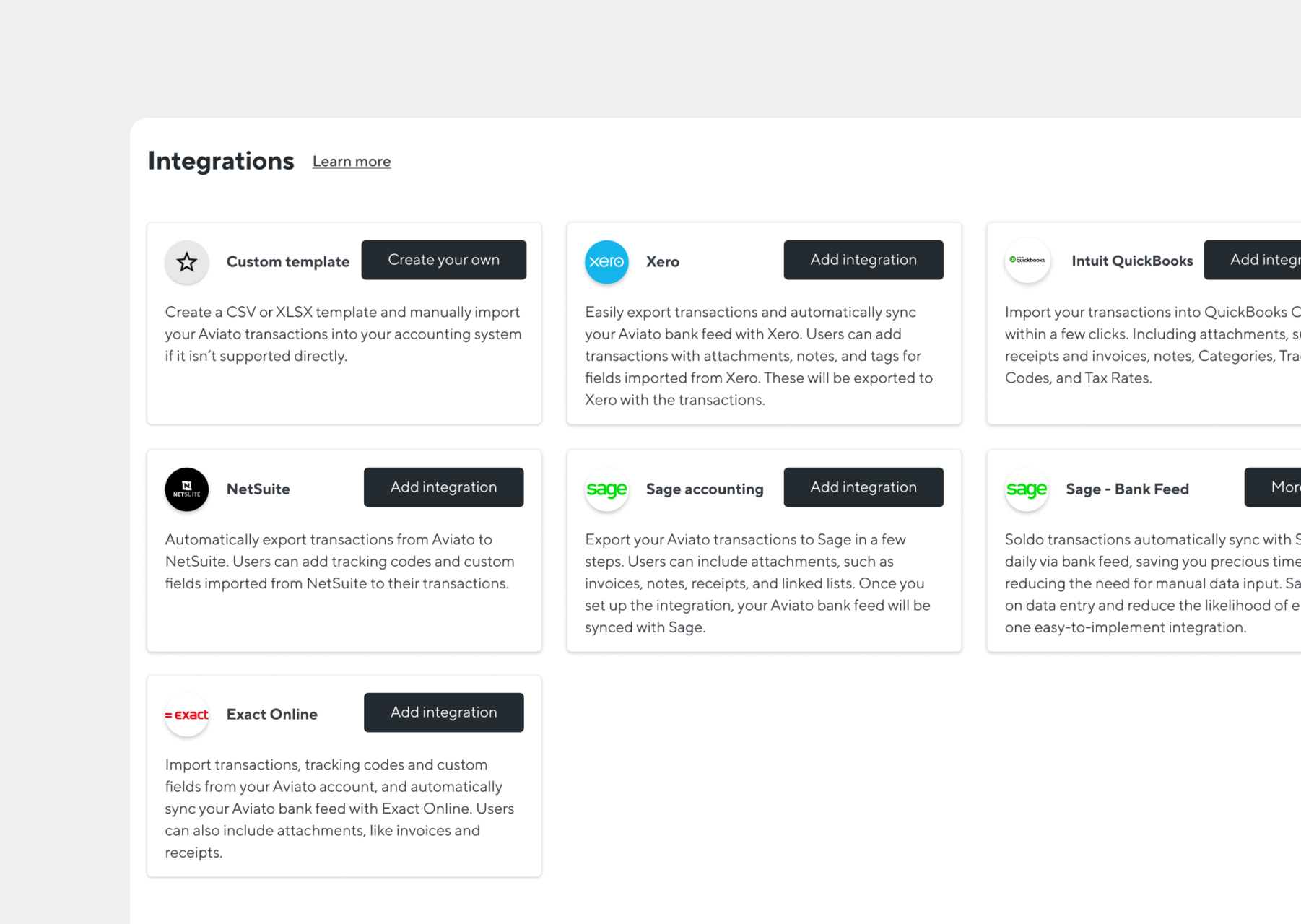

Bring your data together

We have integrations with leading Accountancy software and finance systems such as Sage, Xero, Exact Online and NetSuite so you can bring together all your financial data for accurate reconciliation and accounting of expenses.