How to control costs without slowing business growth

Setting spending limits and rules on Soldo cards

Good cost management is useful no matter where your business is, but it’s particularly instrumental for fast-growing businesses.

One of the biggest drawbacks of using traditional debit or credit cards for company spending is that there are usually not enough of them to be shared across the organisation.

Another is that changing limits on those cards is a slow, inflexible process that involves wasted hours on the phone with banks whenever you need to make changes.

And if you’re asking employees to pay for their own expenses and go through reimbursement claims, that means you have even less control over spending.

Soldo offers prepaid cards that carry only the amount of money you load onto them, and your company can get as many plastic or virtual cards as needed.

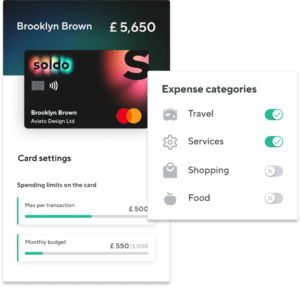

On top of payments, there’s a lot more you can do to control spend with Soldo cards:

- Spend limits – set monthly, weekly, or daily limits on card payments and change them instantly when needed.

- Regulate merchant categories – specify where employees can or can’t use company money on, to prevent people from using it for personal expenses.

- Geographic control – block off regions where your business isn’t present to avoid overseas spending, and enable usage when you expand to new markets or when employees travel for business.

- Individual oversight – manage employee balances individually and actively prevent rogue spending by only topping up cards when it’s necessary.

- Cash withdrawals – prevent certain employees from making cash withdrawals with Soldo cards, or set limits to how much they can withdraw at any given time.

- Single-use virtual payments – following employee request to an admin, create virtual cards for one-time payments, loaded with the exact amount of money for each payment.

Our platform gives you the flexibility to set limits on company spending and grants you oversight of cash flow at all times, with smart, easy-to-use tools.

All this with your finance team yielding control of how and where money is being spent, and at the same time giving employees the autonomy to spend.

But setting spending limits and rules is more effective when you’re aware of the full picture, which brings us to the next step.

Keeping track of spending insights regularly

When you’re not actively tracking spend on a regular basis, and rather waiting until the end of the month to sort through expenditure, you’re delaying or misinforming decisions.

From what we learned after surveying over 250 founders and investors for our spending playbook, around one in five mention their lack of financial insight when making spending decisions.

As a comprehensive platform covering all steps in the expense process, from payment to reconciliation, Soldo gives admins full visibility over company spending through a web console.

The console is where you’re able to create and manage new cards, distribute funds, apply controls, and many other things – but it’s also where you can frequently check up on spend.

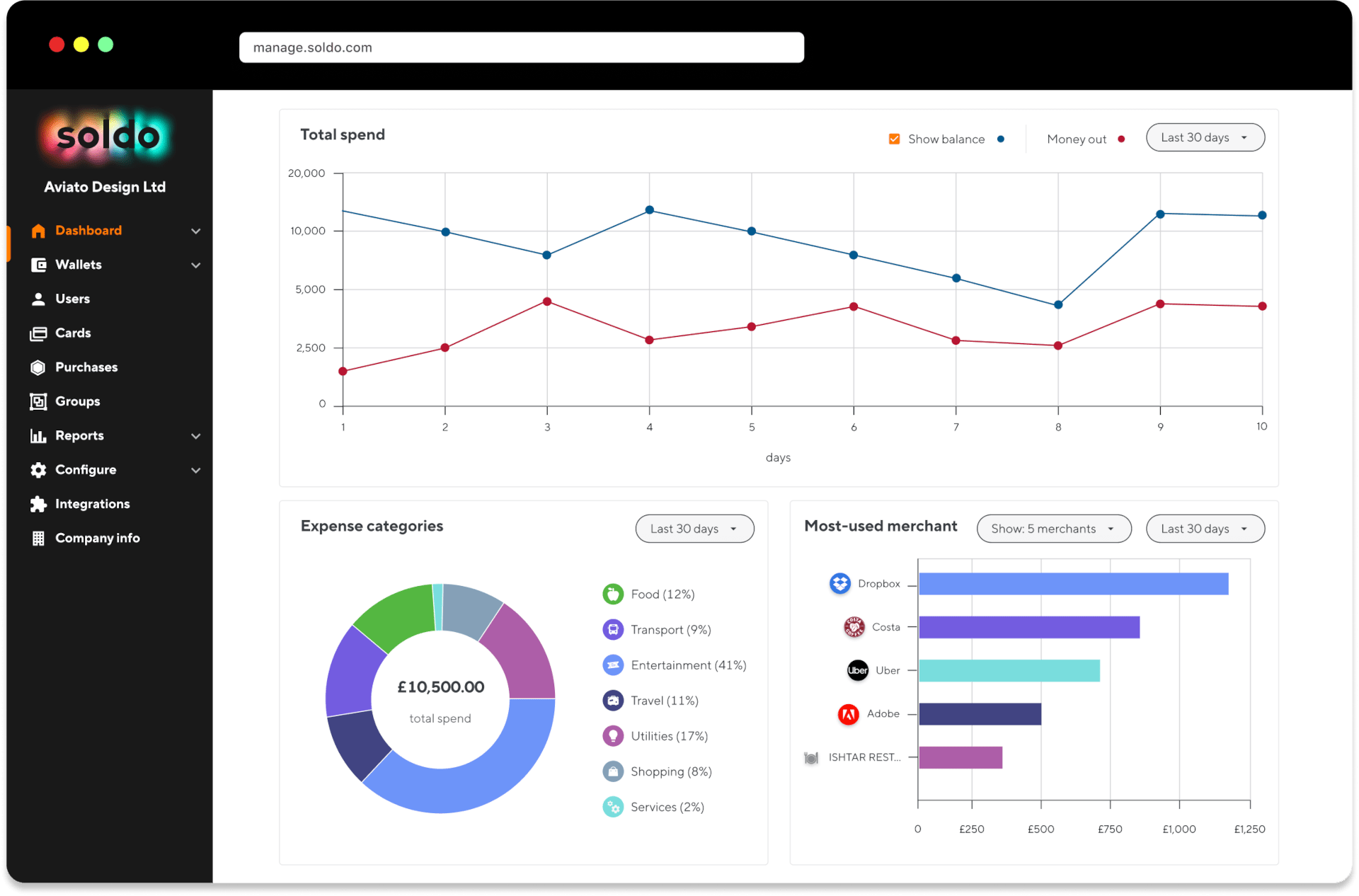

When you log into your Soldo account, you’re presented with a dashboard which gives you a clear view of the staff spending trends across your company.

You can follow your company’s spending trends at a glance and see who is spending the most, and where that money is being spent.

This information is shown in the following graphs:

- Total company spend – an overall look at how much money has been spent across the entire company over a certain period.

- Merchant categories – a pie chart revealing where money has been spent, divided by merchant.

- Total spend by user – a representation of how much the biggest spenders in the business have spent.

Besides the charts, the dashboard also makes it easy to monitor cash flow by showing you the outstanding available balance across all your Soldo wallets – a tool we’ll dive into on the next section. Having a finger on the pulse of your cash position means leaders can make the right calls faster.

Managing funds across the business

You need to spend to support your growth, as you develop your team and hire new talent, as you build more departments, or even new offices – and as you diversify your spending to suit your growth.

Having a tight grip on company funds and knowing how to handle them is crucial, but it’s a much harder task if you’re drowning the finance team and other employees in admin and paperwork to account for all the changes in your spending. This is easier to accomplish using Soldo’s wallet system, which helps you organise your funds across your entire business.

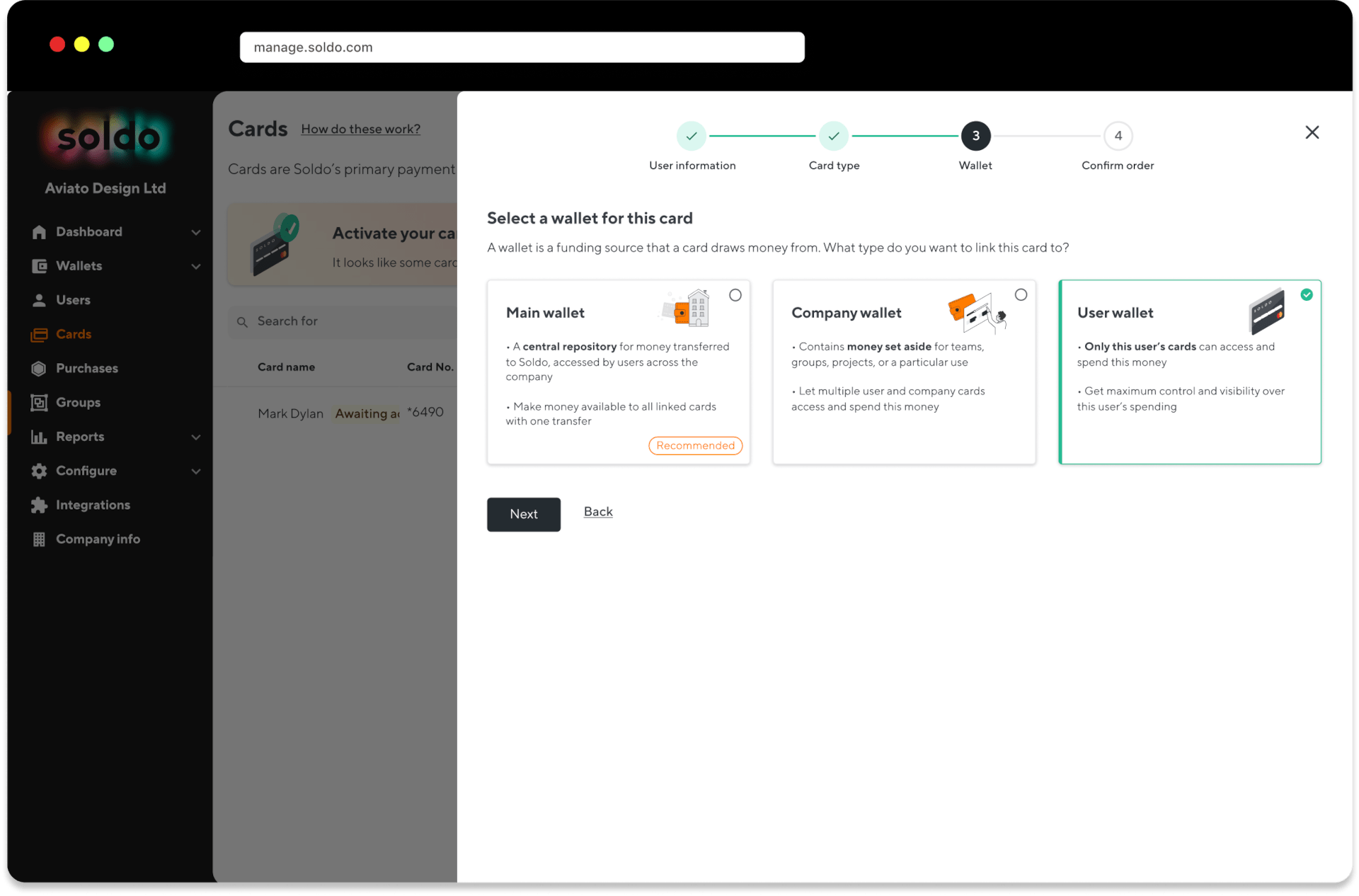

Here’s how it works:

Your Main Wallets receive money from your bank account, so they can then feed other wallets.

- You can use Company Wallets to fund projects, teams, departments, or spending types (e.g., software subscriptions).

- Certain employees may have User Wallets associated with their Soldo cards, so you can attribute funds to be used by specific people only.

- Soldo also offers Company Cards, which enable different users to share expenses under one card – such as a dedicated card to pay for office supplies – and you can tie these cards to a Reserved Wallet to ring-fence funds.

Wallets and company cards give you the flexibility to sort funds in a way that makes sense to your company hierarchy and teams – but, more importantly when you’re trying to stay on top of costs, it makes tracking spend much easier. You’ll know exactly where your money is going, and have more control over budgeting, all in real time. The result? You can grow however you want and drastically minimise end-of-the-month surprises that could hinder your progress.

Creating roles and permissions to mirror real life

People on your team have different jobs and responsibilities, and that can be helpful when trying to manage costs more closely.

You’ve already seen what you can do with our wallet system in terms of mapping out your business in Soldo so that your budgets align with your company structure – but you can also reflect employees’ roles into your Soldo account.

Soldo enables you to assign different roles (e.g., employee, manager, accountant, admin, etc.) and match permissions to give them different levels of access to funds and data.

With the following tools, you’ll be able to further organise spending, as well as tracking it closely, so that you have a better chance to control costs:

- Roles – Assign roles to different employees according to their jobs and responsibilities, from spender to manager and administrator of the Soldo account.

- Permissions – Assign different permissions to each role to define which users have access to certain functionalities.

- Scope – Assign visibility to managers over a particular set of resources (wallets, company cards, etc.), so more people can keep an eye out for you.

One user can be assigned to all three available categories (admin, manager, employee), and they can decide which one they use in their Soldo app. Selected users can alternate from accessing the entire account as an administrator, or seeing their own resources like other employees.

This way, Soldo can match your company’s real-world roles with their actual responsibilities, promoting more accountability on spending across the business.

Seeing and controlling spending in real time

We’ve mentioned how growing can affect your company’s ability to control costs, and a big part of that is because there’s more to monitor. During a fast-growth period, you’ll be navigating a sea of new advertising and marketing costs, travel expenses, monthly software subscriptions, and whatever else you suddenly, urgently need. And, at this point, having a clear view of everything you’re investing company money on is crucial – there will be more admin to work through, and that can quickly pile up and make your finance team lose track of spending. This is where the real-time visibility that Soldo offers can make a difference in your growth journey. Instead of wasting days putting together company-wide expenditure and spend data, your team can use Soldo to see all payments as they happen, and get instant insights into individual transactions and overall spend. Admins have access to a clearer view of spending – but, on top of that, Soldo bridges the gap between your legacy finance systems and real-world spending habits. You can integrate your spending data with your systems and business analytic tools to track spending on a granular level.

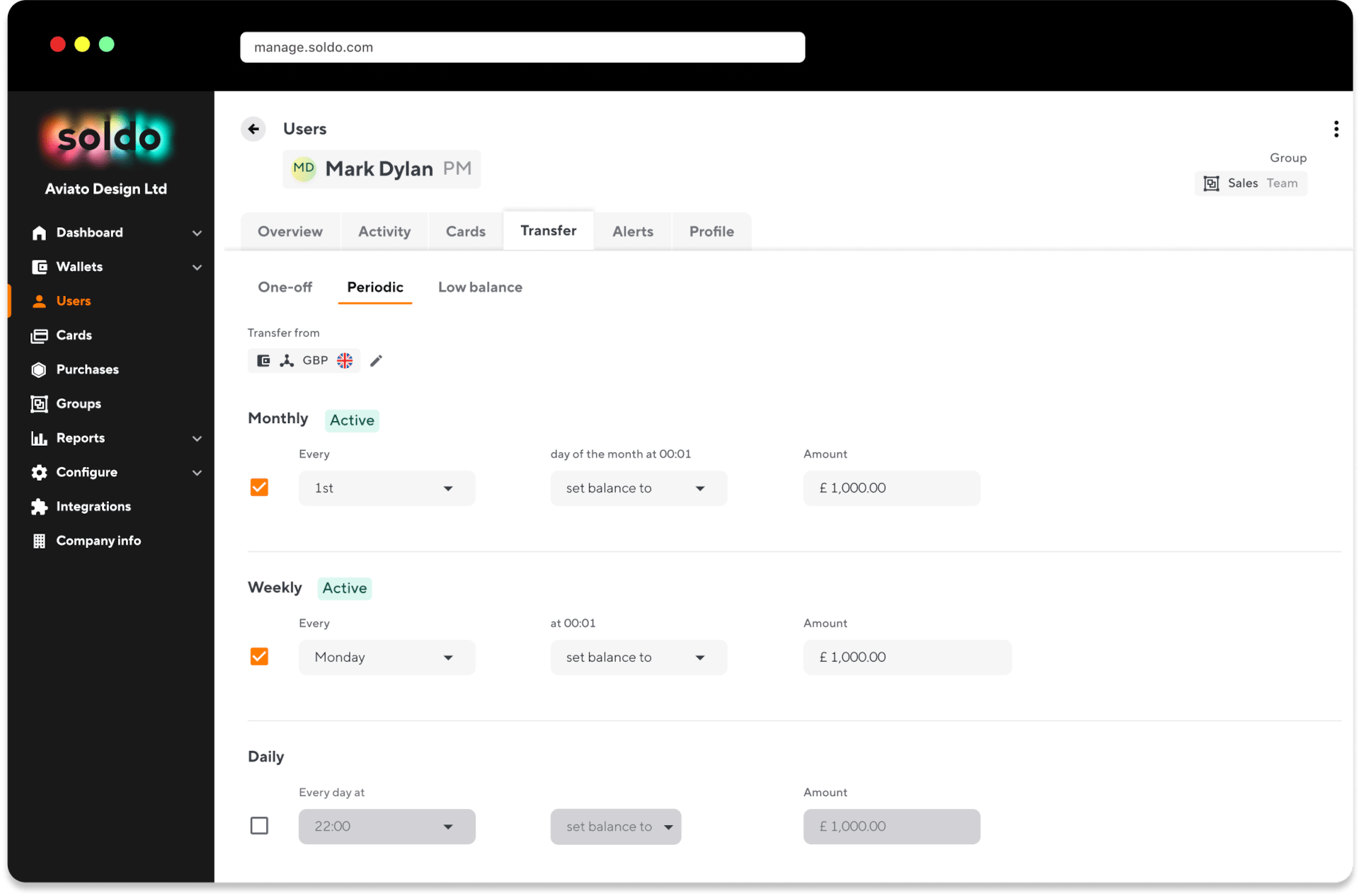

And the cherry on top is that your finance team will have even more of an upper hand when controlling company money, thanks to Soldo’s notifications and alerts:

- You can set up email notifications for when a wallet or a card balance drops below a certain amount.

- To ensure employees always have funds available to them, you can very easily set up automatic transfers to their cards.

- Soldo can notify you whenever someone fails to upload a receipt or other transaction information.

It’s a win-win: you empower your employees by always knowing when they need more funds and giving them what they need to do their jobs, and you get to see spending as it happens, which saves time and admin headaches all around.

Most of all, though, real-time visibility gives you the ability to control costs on the spot, to make smarter budgeting decisions in the future, and a clear picture of your cash flow. You can focus on growing without worrying about spending.