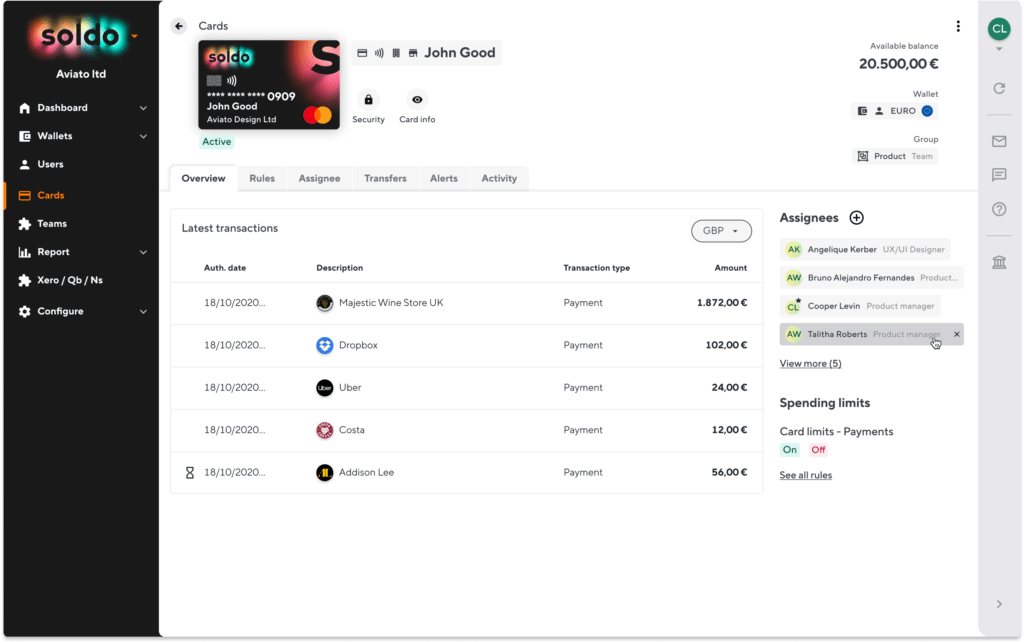

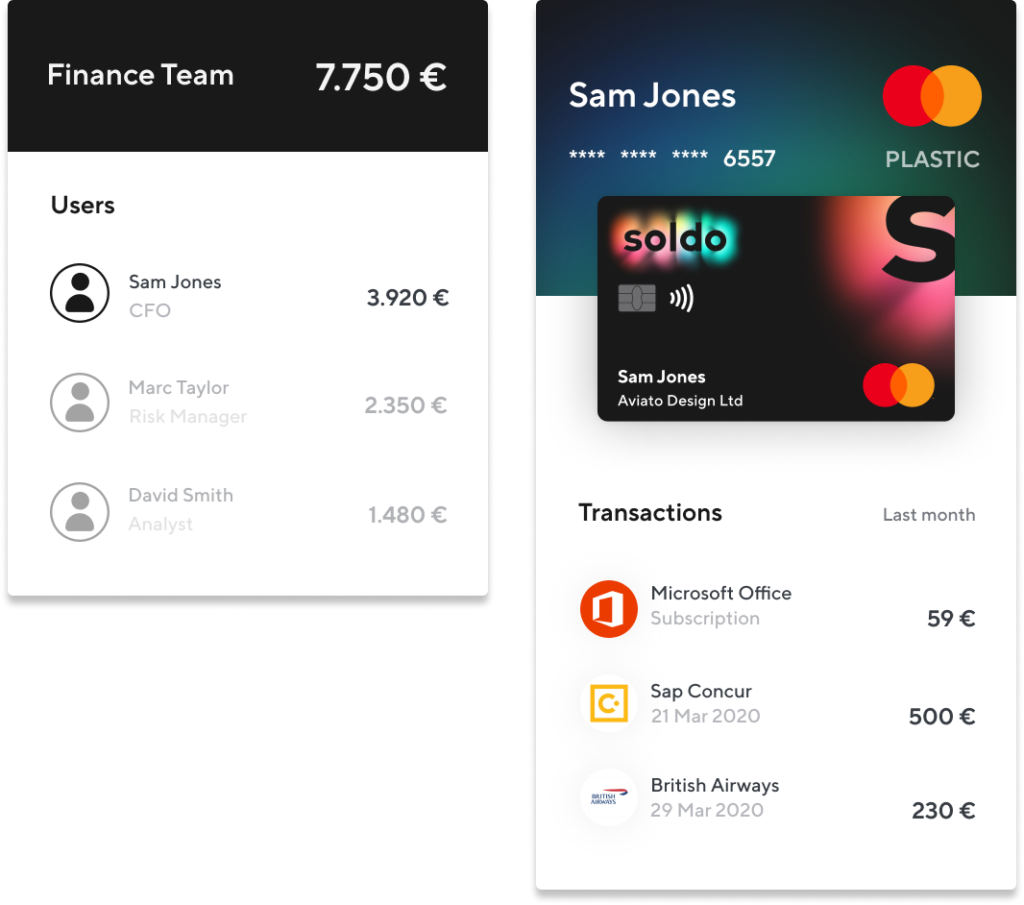

Control costs on prepaid cards

Enable trouble-free business spending; define budgets and track costs in real time.

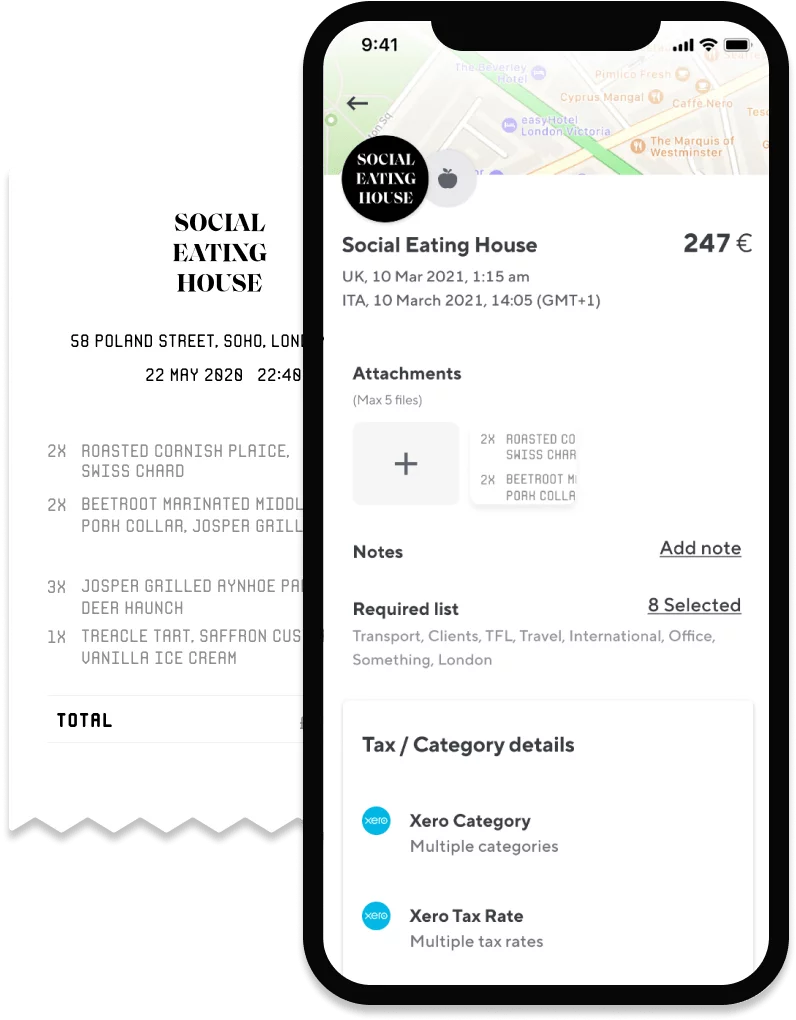

Capture receipts and VAT

Prompt employees to capture invoices and add VAT, categories, and more on the Soldo mobile app.

Automate all expense admin

Send transactions, receipts, and other data to your accounting software through integrations.

Get up and running in a flash

Apply online in minutes and start spending in as little as one working day. You’ll love how easy it all is.