We work closely with accountants and bookkeeper on our partner programme to make sure Soldo delivers everything practices need to succeed.

Effortless expenses

Streamline expense management for you and your clients with apps that make receipt capture and reporting beautifully simple.

Real-time visibility

Get everything you need to provide timely, accurate advice with a real-time view of client spending that finally includes expenses.

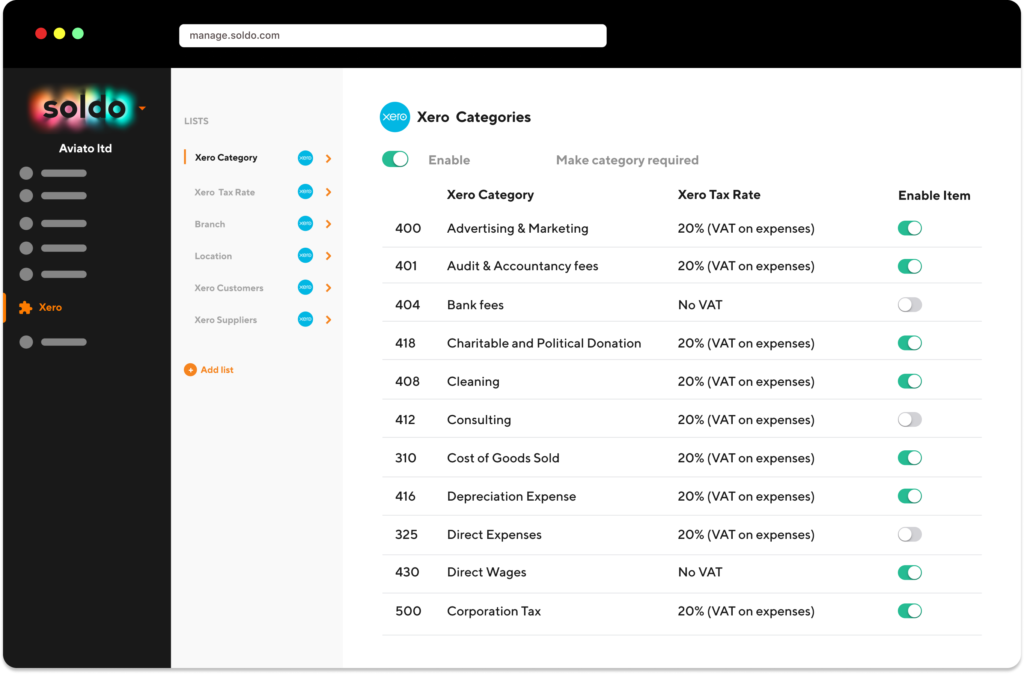

Seamless accounting

Export client transactions and their data to any major accounting platform for easy reconciliation and audit-proofed books.